Page 555 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 555

Chapter 9. Design and Communication Considerations 541

Table 9-15. (continued from previous page)

Variations in Stock Award Plans

• Fixed number of shares to be received at a fixed date. Since they lack a performance feature,

shareholders do not like these plans, even though they may be used to attract a talented person

to the company and/or lock in a person who otherwise might leave.

• Fixed number of shares to be received at a variable date.The award typically has a target date but

could be received earlier or later, depending when and if performance factors are met.

• Variable number of shares to be received at a fixed date.This is frequently described as the

traditional performance-share plan.

• Variable number of shares to be received at variable dates.This type of plan establishes performance

factors for both amount and date.

Stock awards given at the right time in relation to desired performance are very appro-

priate, especially since they are perceived as being of higher value than stock options by most

executives and do not rely on a rising stock price. But as stated repeatedly throughout this

book, stock options should be the vehicle of choice during start-up and the first phase of

growth in the market cycle, not during the mature stage.

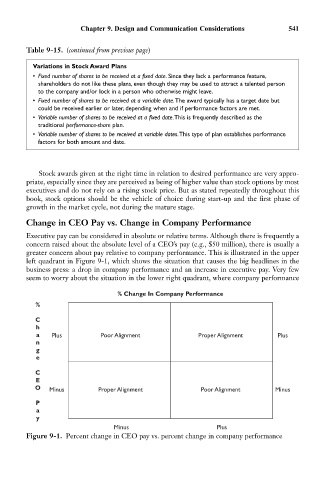

Change in CEO Pay vs. Change in Company Performance

Executive pay can be considered in absolute or relative terms. Although there is frequently a

concern raised about the absolute level of a CEO’s pay (e.g., $50 million), there is usually a

greater concern about pay relative to company performance. This is illustrated in the upper

left quadrant in Figure 9-1, which shows the situation that causes the big headlines in the

business press: a drop in company performance and an increase in executive pay. Very few

seem to worry about the situation in the lower right quadrant, where company performance

% Change In Company Performance

%

C

h

a Plus Poor Alignment Proper Alignment Plus

n

g

e

C

E

O Minus Proper Alignment Poor Alignment Minus

P

a

y

Minus Plus

Figure 9-1. Percent change in CEO pay vs. percent change in company performance