Page 556 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 556

542 The Complete Guide to Executive Compensation

went up but CEO pay went down. The other two quadrants reflect a positive correlation

between CEO pay and company performance. But where correlation is negative, one must

be cautious in concluding that it is inappropriate. For example, a large increase in CEO pay

may have been because of a very large stock option exercise, conversely, pay may be decreased

because the large stock option exercise was in the previous year.

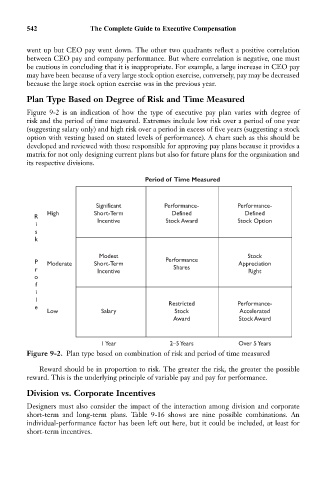

Plan Type Based on Degree of Risk and Time Measured

Figure 9-2 is an indication of how the type of executive pay plan varies with degree of

risk and the period of time measured. Extremes include low risk over a period of one year

(suggesting salary only) and high risk over a period in excess of five years (suggesting a stock

option with vesting based on stated levels of performance). A chart such as this should be

developed and reviewed with those responsible for approving pay plans because it provides a

matrix for not only designing current plans but also for future plans for the organization and

its respective divisions.

Period of Time Measured

Significant Performance- Performance-

High Short-Term Defined Defined

R

i Incentive Stock Award Stock Option

s

k

Modest Stock

P Moderate Short-Term Performance Appreciation

r Incentive Shares Right

o

f

i

l

Restricted Performance-

e

Low Salary Stock Accelerated

Award Stock Award

1 Year 2–5 Years Over 5 Years

Figure 9-2. Plan type based on combination of risk and period of time measured

Reward should be in proportion to risk. The greater the risk, the greater the possible

reward. This is the underlying principle of variable pay and pay for performance.

Division vs. Corporate Incentives

Designers must also consider the impact of the interaction among division and corporate

short-term and long-term plans. Table 9-16 shows are nine possible combinations. An

individual-performance factor has been left out here, but it could be included, at least for

short-term incentives.