Page 619 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 619

Five Year

One Year

Five Year

Average

Return on

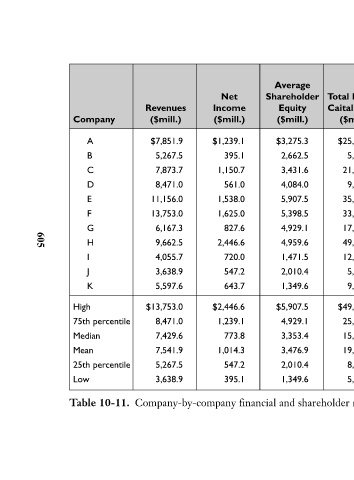

T otal Market T otal T otal Return on Average Shareholder Shareholder Average Shareholder Caitalization Return Return Equity Equity ($mill.) 180.40% 10.14% 35.0% 37.8% $25,395.1 58.50% 8.56% 11.7% 14.8% 5,190.5 127.30% 17.34% 58.3% 33.5% 21,130.7 60.90% 17.01% 8.9% 13.7% 9,043.4 95.40% 21.17% 26.4% 26.0% 35,190.6 19

Average Shareholder Equity ($mill.) $3,275.3 2,662.5 3,431.6 4,084.0 5,907.5 5,398.5 4,929.1 4,959.6 1,471.5 2,010.4 1,349.6 $5,907.5 4,929.1 3,353.4 3,476.9 2,010.4 1,349.6 Company-by-company financial and shareholder return comparisons

Net Income ($mill.) $1,239.1 395.1 1,150.7 561.0 1,538.0 1,625.0 827.6 2,446.6 720.0 547.2 643.7 $2,446.6 1,239.1 773.8 1,014.3 547.2 395.1

Revenues ($mill.) $7,851.9 5,267.5 7,873.7 8,471.0 11,156.0 13,753.0 6,167.3 9,662.5 4,055.7 3,638.9 5,597.6 $13,753.0 8,471.0 7,429.6 7,541.9 5,267.5 3,638.9

Company A B C D E F G H I J K High 75th percentile Median Mean 25th percentile Low Table 10-11.

605