Page 653 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 653

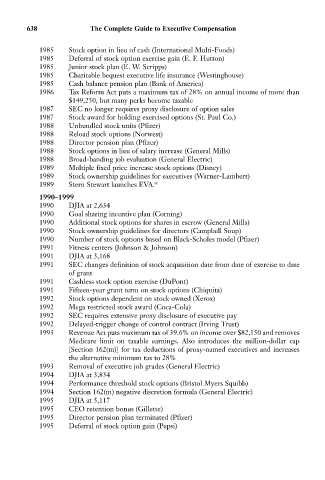

638 The Complete Guide to Executive Compensation

1985 Stock option in lieu of cash (International Multi-Foods)

1985 Deferral of stock option exercise gain (E. F. Hutton)

1985 Junior stock plan (E. W. Scripps)

1985 Charitable bequest executive life insurance (Westinghouse)

1985 Cash balance pension plan (Bank of America)

1986 Tax Reform Act puts a maximum tax of 28% on annual income of more than

$149,250, but many perks become taxable

1987 SEC no longer requires proxy disclosure of option sales

1987 Stock award for holding exercised options (St. Paul Co.)

1988 Unbundled stock units (Pfizer)

1988 Reload stock options (Norwest)

1988 Director pension plan (Pfizer)

1988 Stock options in lieu of salary increase (General Mills)

1988 Broad-banding job evaluation (General Electric)

1989 Multiple fixed price increase stock options (Disney)

1989 Stock ownership guidelines for executives (Warner-Lambert)

1989 Stern Stewart launches EVA. ®

1990–1999

1990 DJIA at 2,634

1990 Goal sharing incentive plan (Corning)

1990 Additional stock options for shares in escrow (General Mills)

1990 Stock ownership guidelines for directors (Campbell Soup)

1990 Number of stock options based on Black-Scholes model (Pfizer)

1991 Fitness centers (Johnson & Johnson)

1991 DJIA at 3,168

1991 SEC changes definition of stock acquisition date from date of exercise to date

of grant

1991 Cashless stock option exercise (DuPont)

1991 Fifteen-year grant term on stock options (Chiquita)

1992 Stock options dependent on stock owned (Xerox)

1992 Mega restricted stock award (Coca-Cola)

1992 SEC requires extensive proxy disclosure of executive pay

1992 Delayed-trigger change of control contract (Irving Trust)

1993 Revenue Act puts maximum tax of 39.6% on income over $82,150 and removes

Medicare limit on taxable earnings. Also introduces the million-dollar cap

[Section 162(m)] for tax deductions of proxy-named executives and increases

the alternative minimum tax to 28%

1993 Removal of executive job grades (General Electric)

1994 DJIA at 3,834

1994 Performance threshold stock options (Bristol Myers Squibb)

1994 Section 162(m) negative discretion formula (General Electric)

1995 DJIA at 5,117

1995 CEO retention bonus (Gillette)

1995 Director pension plan terminated (Pfizer)

1995 Deferral of stock option gain (Pepsi)