Page 654 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 654

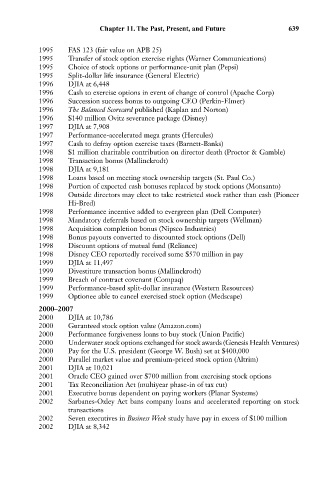

Chapter 11. The Past, Present, and Future 639

1995 FAS 123 (fair value on APB 25)

1995 Transfer of stock option exercise rights (Warner Communications)

1995 Choice of stock options or performance-unit plan (Pepsi)

1995 Split-dollar life insurance (General Electric)

1996 DJIA at 6,448

1996 Cash to exercise options in event of change of control (Apache Corp)

1996 Succession success bonus to outgoing CEO (Perkin-Elmer)

1996 The Balanced Scorecard published (Kaplan and Norton)

1996 $140 million Ovitz severance package (Disney)

1997 DJIA at 7,908

1997 Performance-accelerated mega grants (Hercules)

1997 Cash to defray option exercise taxes (Barnett-Banks)

1998 $1 million charitable contribution on director death (Proctor & Gamble)

1998 Transaction bonus (Mallinckrodt)

1998 DJIA at 9,181

1998 Loans based on meeting stock ownership targets (St. Paul Co.)

1998 Portion of expected cash bonuses replaced by stock options (Monsanto)

1998 Outside directors may elect to take restricted stock rather than cash (Pioneer

Hi-Bred)

1998 Performance incentive added to evergreen plan (Dell Computer)

1998 Mandatory deferrals based on stock ownership targets (Wellman)

1998 Acquisition completion bonus (Nipsco Industries)

1998 Bonus payouts converted to discounted stock options (Dell)

1998 Discount options of mutual fund (Reliance)

1998 Disney CEO reportedly received some $570 million in pay

1999 DJIA at 11,497

1999 Divestiture transaction bonus (Mallinckrodt)

1999 Breach of contract covenant (Compaq)

1999 Performance-based split-dollar insurance (Western Resources)

1999 Optionee able to cancel exercised stock option (Medscape)

2000–2007

2000 DJIA at 10,786

2000 Guranteed stock option value (Amazon.com)

2000 Performance forgiveness loans to buy stock (Union Pacific)

2000 Underwater stock options exchanged for stock awards (Genesis Health Ventures)

2000 Pay for the U.S. president (George W. Bush) set at $400,000

2000 Parallel market value and premium-priced stock option (Altrim)

2001 DJIA at 10,021

2001 Oracle CEO gained over $700 million from exercising stock options

2001 Tax Reconciliation Act (multiyear phase-in of tax cut)

2001 Executive bonus dependent on paying workers (Planar Systems)

2002 Sarbanes-Oxley Act bans company loans and accelerated reporting on stock

transactions

2002 Seven executives in Business Week study have pay in excess of $100 million

2002 DJIA at 8,342