Page 353 - The Green Building Bottom Line The Real Cost of Sustainable Building

P. 353

330 CHAPTER 10

ears

Y Years 0 1 2 3

REVENUES

REVENUES

21,300

Shaping values, chapter 21,300 21,300 21,300

21,300

21,300

Shaping values, chapter 11

cultur

eating

fg

79,000

chapter

Creating a culture of green glue, chapter 22 79,000 79,000 79,000

79,000

glue,

eo

een

r

Cr

79,000

a

om

out,

inside

chapter

een

fr

3,300

3,300

3,300

Green from the inside out, chapter 33 3,300 3,300 3,300

the

Gr

Developing expertise in LEED, chapter 0 0 0

Developing expertise in LEED, chapter 44

okerage,

Sustainable

br

Sustainable brokerage, chapterchapter 8 8 0 0 0

marketing,

chapter

Gr

Green marketing, chapter 1010

een

Sale of Gr een, Inc.

Sale of Green, Inc.

103,600

103,600

103,600

Total Revenuesotal Revenues 103,600 103,600 103,600

EXPENSES

EXPENSES

Shaping values, chapter 11 (166,000) (1 (114,500) (91,875) (97,286)

Shaping

(166,000)

chapter

14,500)

(97,286)

(91,875)

values,

(57,600)

(64,631)

Cr eating a cultur eo fg r een glue, chapter 0 (57,600) (64,631) (72,717)

(72,717)

Creating a culture of green glue, chapter 22

(22,998)

(22,381)

the

chapter

om

out,

(78,490)

fr

inside

Green from the inside out, chapter 33 0 (78,490) (22,381) (22,998)

een

Gr

in

LEED,

expertise

Developing

(890,000)

Developing expertise in LEED, chapter 44 (49,000) (150,000) (417,000) (890,000)

(49,000)

(150,000)

(417,000)

chapter

Sustainable brokerage, chapterchapter 8 8 0 0 0 0

br

Sustainable

okerage,

(35,800)

for

(35,800)

Overmarket costs for marketing, chapter 1010 (35,800) (35,800) (35,800)

Overmarket

marketing,

(35,800)

chapter

costs

(215,000)

(436,390)

(631,688)

(1,118,802)

Total Expensesotal Expenses (215,000) (436,390) (631,688) (1,1 18,802)

(215,000)

(1,015,202)

Total Cashflowotal Cashflow (215,000) (332,790) (528,088) (1,015,202)

(332,790)

(528,088)

Discount Factor 1.00 0.91 0.83 0.75

0.75

Discount Factor

0.83

0.91

1.00

PV CashflowCashflow

PV (215,000) (302,536) (436,436) (762,736)

(302,536)

(436,436)

(215,000)

(762,736)

NPV

NPV 2,401,349

2,401,349

IRR

IRR 27.94%

27.94%

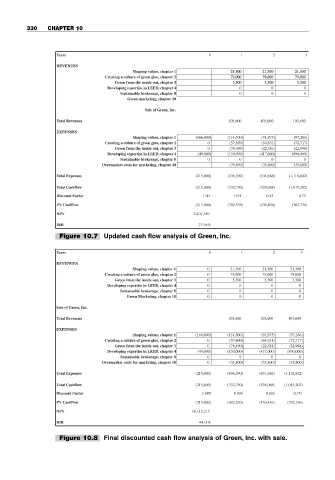

Figure 10.7 Updated cash flow analysis of Green, Inc.

Y Yearsears 0 1 2 3

REVENUES

REVENUES

values,

Shaping

chapter

21,300

21,300

Shaping values, chapter 11 0 21,300 21,300 21,300

21,300

glue,

a

79,000

een

eating

r

chapter

Creating a culture of green glue, chapter 22 0 79,000 79,000 79,000

eo

fg

cultur

Cr

79,000

79,000

3,300

fr

chapter

3,300

een

the

Gr

inside

Green from the inside out, chapter 33 0 3,300 3,300 3,300

om

3,300

out,

Developing expertise in LEED, chapter 44 0 0 0 0

Developing

expertise

in

chapter

LEED,

Sustainable brokerage, chapterchapter 8

Sustainable br okerage, 8 0 0 0 0

Marketing,

Green Marketing, chapter 1010 0 0 0 0

chapter

een

Gr

een,

Sale

Inc.

of

Gr

Sale of Green, Inc.

103,600

103,600

103,600

Total Revenuesotal Revenues 103,600 103,600 103,600

EXPENSES

EXPENSES

14,500)

chapter

(166,000)

Shaping values, chapter 11 (166,000) (1 (114,500) (91,875) (97,286)

values,

(97,286)

Shaping

(91,875)

Creating a culture of green glue, chapter 22

(64,631)

(72,717)

Cr eating a cultur eo fg r een glue, chapter 0 (57,600) (64,631) (72,717)

(57,600)

Green from the inside out, chapter 33 0 (78,490) (22,381) (22,998)

om

een

fr

out,

(22,998)

inside

(22,381)

the

Gr

chapter

(78,490)

(49,000)

(890,000)

Developing expertise in LEED, chapter (49,000) (150,000) (417,000) (890,000)

Developing expertise in LEED, chapter 44

(150,000)

(417,000)

Sustainable br okerage, 8 0 0 0 0

Sustainable brokerage, chapterchapter 8

(35,800)

marketing,

Overmarket

for

costs

(35,800)

Overmarket costs for marketing, chapterchapter 1010 0 (35,800) (35,800) (35,800)

(35,800)

(1,118,802)

Total Expensesotal Expenses (215,000) (436,390) (631,688) (1,1 18,802)

(436,390)

(215,000)

(631,688)

(1,015,202)

(215,000)

(528,088)

Total Cashflowotal Cashflow (215,000) (332,790) (528,088) (1,015,202)

(332,790)

0.751

Discount Factor 1.000 0.909 0.826 0.751

Discount

1.000

0.909

0.826

Factor

(215,000)

PV CashflowCashflow

PV (215,000) (302,536) (436,436) (762,736)

(302,536)

(436,436)

(762,736)

NPV 10,112,215

NPV

12,215

10,1

IRR

IRR 44.11%

44.1

1%

Figure 10.8 Final discounted cash flow analysis of Green, Inc. with sale.