Page 465 -

P. 465

PERIODIC REVIEW MODEL WITH PROBABILISTIC DEMAND 445

a. Minimum cost order quantity.

b. Maximum number of backorders.

c. Maximum inventory.

d. Cycle time.

e. Total annual cost.

10 Assuming 250 days of operation per year and a lead time of five days, what is the reorder

point for Suyuti Auto in Problem 9? Show the general formula for the reorder point for the

EOQ model with backorders. In general, is the reorder point when backorders are allowed

greater than or less than the reorder point when backorders are not allowed? Explain.

11 A manager of an inventory system believes that inventory models are important decision-

making aids. Even though often using an EOQ policy, the manager never considered a

backorder model because of the assumption that backorders were ‘bad’ and should be

avoided. However, with upper management’s continued pressure for cost reduction, you

have been asked to analyze the economics of a back-ordering policy for some products

that can possibly be back ordered. For a specific product with D ¼ 800 units per year,

C o ¼ E150, C h ¼ E3 and C b ¼ E20, what is the difference in total annual cost between the

EOQ model and the planned shortage or backorder model? If the manager adds

constraints that no more than 25 per cent of the units can be back ordered and that no

customer will have to wait more than 15 days for an order, should the backorder inventory

policy be adopted? Assume 250 working days per year.

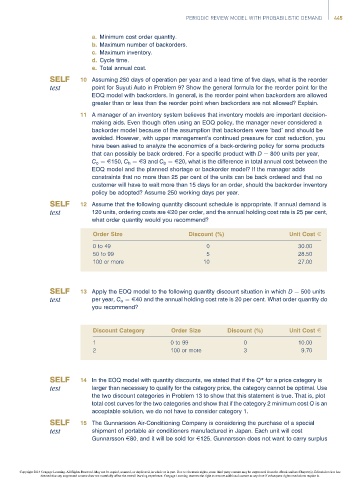

12 Assume that the following quantity discount schedule is appropriate. If annual demand is

120 units, ordering costs are E20 per order, and the annual holding cost rate is 25 per cent,

what order quantity would you recommend?

Order Size Discount (%) Unit Cost E

0 to 49 0 30.00

50 to 99 5 28.50

100 or more 10 27.00

13 Apply the EOQ model to the following quantity discount situation in which D ¼ 500 units

per year, C o ¼ E40 and the annual holding cost rate is 20 per cent. What order quantity do

you recommend?

Discount Category Order Size Discount (%) Unit Cost E

1 0 to 99 0 10.00

2 100 or more 3 9.70

14 In the EOQ model with quantity discounts, we stated that if the Q* for a price category is

larger than necessary to qualify for the category price, the category cannot be optimal. Use

the two discount categories in Problem 13 to show that this statement is true. That is, plot

total cost curves for the two categories and show that if the category 2 minimum cost Q is an

acceptable solution, we do not have to consider category 1.

15 The Gunnarsson Air-Conditioning Company is considering the purchase of a special

shipment of portable air conditioners manufactured in Japan. Each unit will cost

Gunnarsson E80, and it will be sold for E125. Gunnarsson does not want to carry surplus

Copyright 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part. Due to electronic rights, some third party content may be suppressed from the eBook and/or eChapter(s). Editorial review has

deemed that any suppressed content does not materially affect the overall learning experience. Cengage Learning reserves the right to remove additional content at any time if subsequent rights restrictions require it.