Page 89 -

P. 89

GENERAL LINEAR PROGRAMMING NOTATION 69

funds, B&R’s risk rating for the portfolio would be 6(10) + 4(10) ¼ 100. Finally, B&R has developed a

questionnaire to measure each client’s risk tolerance. Based on the responses, each client is classified as a

conservative, moderate or aggressive investor. The questionnaire results have classified the current client as

a moderate investor. B&R recommends that a client who is a moderate investor limit his or her portfolio to a

maximum risk rating of 240. You have been asked to help the B&R investment advisor.

a. What is the recommended investment portfolio for this client?

b. What is the annual return for the portfolio?

c. A second client, also with £500000 to invest, has been classified as an aggressive investor. B&R recommends

that the maximum portfolio risk rating for an aggressive investor is 320. What is the recommended investment

portfolio for this aggressive investor? Explain what happens to the portfolio under the aggressive investor strategy.

Solution

Let us formulate the LP problem for the first investor. We will let X equal the investment made in the Internet

fund and Y the investment made in the Blue Chip fund. X and Y will then be our decision variables. It seems

reasonable to assume that the client will want to maximize the return on their investment so we will need a

Maximization objective function. We would then have a formulation:

Max 0:12X þ 0:09Y

s:t: X þ Y 500000

X 350000

0:0006X þ 0:0004Y 240

X; Y 0

Note: we have shown the annual returns in the objective function in percentage terms (0.12, and .09) so that the

solution will show the actual annual return in £s directly. You could have formulated the OF as 12X +9Y as well.

We have not drawn a graph of this problem (although you might want to to get some extra practise) but simply used

Excel. The output is shown in Exhibit 2.1.

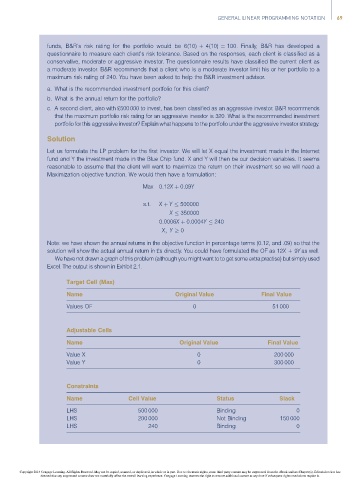

Target Cell (Max)

Name Original Value Final Value

Values OF 0 51 000

Adjustable Cells

Name Original Value Final Value

Value X 0 200 000

Value Y 0 300 000

Constraints

Name Cell Value Status Slack

LHS 500 000 Binding 0

LHS 200 000 Not Binding 150 000

LHS 240 Binding 0

Copyright 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part. Due to electronic rights, some third party content may be suppressed from the eBook and/or eChapter(s). Editorial review has

deemed that any suppressed content does not materially affect the overall learning experience. Cengage Learning reserves the right to remove additional content at any time if subsequent rights restrictions require it.