Page 341 - Analysis, Synthesis and Design of Chemical Processes, Third Edition

P. 341

alternatives each with a different operating cost, capital cost, and equipment life?

Do you agree with the statement, “Monte Carlo simulation enables the design engineer to eliminate risk

6. in economic analysis.” Please explain your answer.

7. In evaluating a large project, what are the advantages and disadvantages of probabilistic analysis?

Problems

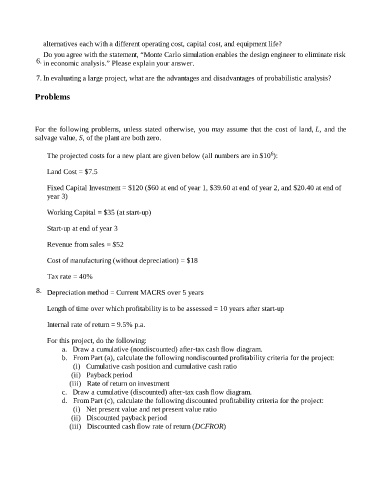

For the following problems, unless stated otherwise, you may assume that the cost of land, L, and the

salvage value, S, of the plant are both zero.

6

The projected costs for a new plant are given below (all numbers are in $10 ):

Land Cost = $7.5

Fixed Capital Investment = $120 ($60 at end of year 1, $39.60 at end of year 2, and $20.40 at end of

year 3)

Working Capital = $35 (at start-up)

Start-up at end of year 3

Revenue from sales = $52

Cost of manufacturing (without depreciation) = $18

Tax rate = 40%

8. Depreciation method = Current MACRS over 5 years

Length of time over which profitability is to be assessed = 10 years after start-up

Internal rate of return = 9.5% p.a.

For this project, do the following:

a. Draw a cumulative (nondiscounted) after-tax cash flow diagram.

b. From Part (a), calculate the following nondiscounted profitability criteria for the project:

(i) Cumulative cash position and cumulative cash ratio

(ii) Payback period

(iii) Rate of return on investment

c. Draw a cumulative (discounted) after-tax cash flow diagram.

d. From Part (c), calculate the following discounted profitability criteria for the project:

(i) Net present value and net present value ratio

(ii) Discounted payback period

(iii) Discounted cash flow rate of return (DCFROR)