Page 340 - Analysis, Synthesis and Design of Chemical Processes, Third Edition

P. 340

1. Humphreys, K. K., Jelen’s Cost and Optimization Engineering , 3rd ed. (New York:

McGraw-Hill, 1991).

2. Salvatore, D., Schaum’s Outline of Theory and Problems of Microeconomic Theory , 3rd

ed. (New York: McGraw-Hill, 1992).

3. Torries, T. F., Evaluating Mineral Projects: Applications and Misconceptions (Littleton,

CO: SME, 1998).

4. http://www.geocities.com/gunjansaraf/yogi.htm.

5. Resnick, W., Process Analysis and Design for Chemical Engineers (New York:

McGraw-Hill, 1981).

6. Valle-Riestra, J. F., Project Evaluation in the Chemical Process Industries (New York:

McGraw-Hill, 1983).

7. Rose, L. M., Engineering Investment Decisions: Planning under Uncertainty

(Amsterdam: Elsevier, 1976).

8. Spiegel, M. R., Mathematical Handbook of Formulas and Tables, Schaum’s Outline

Series (New York: McGraw-Hill, 1968).

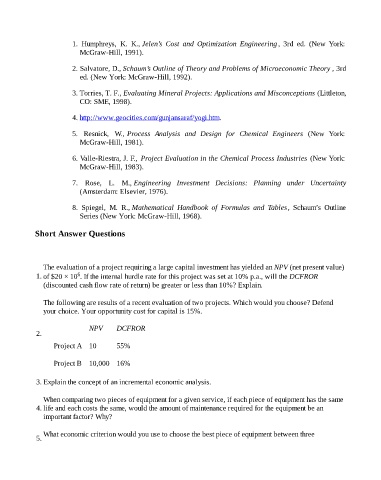

Short Answer Questions

The evaluation of a project requiring a large capital investment has yielded an NPV (net present value)

6

1. of $20 × 10 . If the internal hurdle rate for this project was set at 10% p.a., will the DCFROR

(discounted cash flow rate of return) be greater or less than 10%? Explain.

The following are results of a recent evaluation of two projects. Which would you choose? Defend

your choice. Your opportunity cost for capital is 15%.

NPV DCFROR

2.

Project A 10 55%

Project B 10,000 16%

3. Explain the concept of an incremental economic analysis.

When comparing two pieces of equipment for a given service, if each piece of equipment has the same

4. life and each costs the same, would the amount of maintenance required for the equipment be an

important factor? Why?

What economic criterion would you use to choose the best piece of equipment between three

5.