Page 42 - Budgeting for Managers

P. 42

The Parts of a Budget

Long Term

A long-term budget looks further ahead. What will your depart-

ment be doing for the next five, 10, or 20 years? It may be hard

to imagine. But thinking that far ahead is part of being a good

manager and making a good budget. 25

If the copy shop needs to buy new copiers every five to

seven years, it would be best to know what years we’re likely to

need to do so. That way, we can say, “Three years from now,

we’ll need a new copier.” That’s a lot better than not planning

ahead. If we don’t plan, we could find that we suddenly need to

buy a new copier next month and we didn’t plan for it when we

made the budget for the year.

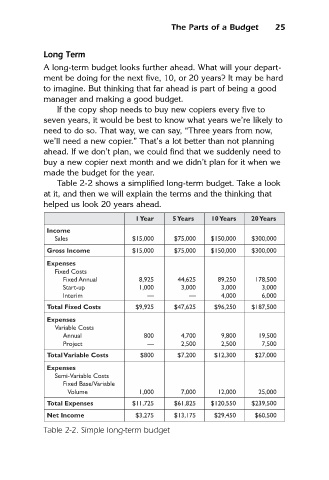

Table 2-2 shows a simplified long-term budget. Take a look

at it, and then we will explain the terms and the thinking that

helped us look 20 years ahead.

1 Year 5 Years 10 Years 20 Years

Income

Sales $15,000 $75,000 $150,000 $300,000

Gross Income $15,000 $75,000 $150,000 $300,000

Expenses

Fixed Costs

Fixed Annual 8,925 44,625 89,250 178,500

Start-up 1,000 3,000 3,000 3,000

Interim — — 4,000 6,000

Total Fixed Costs $9,925 $47,625 $96,250 $187,500

Expenses

Variable Costs

Annual 800 4,700 9,800 19,500

Project — 2,500 2,500 7,500

Total Variable Costs $800 $7,200 $12,300 $27,000

Expenses

Semi-Variable Costs

Fixed Base/Variable

Volume 1,000 7,000 12,000 25,000

Total Expenses $11,725 $61,825 $120,550 $239,500

Net Income $3,275 $13,175 $29,450 $60,500

Table 2-2. Simple long-term budget