Page 86 - Budgeting for Managers

P. 86

Creating a Production Budget

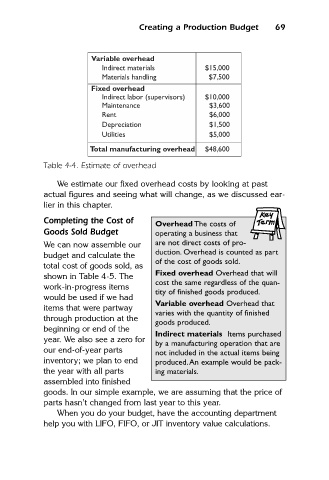

Variable overhead

Indirect materials

Materials handling

$7,500

Fixed overhead

$10,000

Indirect labor (supervisors) $15,000 69

Maintenance $3,600

Rent $6,000

Depreciation $1,500

Utilities $5,000

Total manufacturing overhead $48,600

Table 4-4. Estimate of overhead

We estimate our fixed overhead costs by looking at past

actual figures and seeing what will change, as we discussed ear-

lier in this chapter.

Completing the Cost of

Overhead The costs of

Goods Sold Budget operating a business that

We can now assemble our are not direct costs of pro-

budget and calculate the duction. Overhead is counted as part

of the cost of goods sold.

total cost of goods sold, as

Fixed overhead Overhead that will

shown in Table 4-5. The

cost the same regardless of the quan-

work-in-progress items

tity of finished goods produced.

would be used if we had

Variable overhead Overhead that

items that were partway

varies with the quantity of finished

through production at the

goods produced.

beginning or end of the

Indirect materials Items purchased

year. We also see a zero for

by a manufacturing operation that are

our end-of-year parts not included in the actual items being

inventory; we plan to end produced.An example would be pack-

the year with all parts ing materials.

assembled into finished

goods. In our simple example, we are assuming that the price of

parts hasn’t changed from last year to this year.

When you do your budget, have the accounting department

help you with LIFO, FIFO, or JIT inventory value calculations.