Page 220 -

P. 220

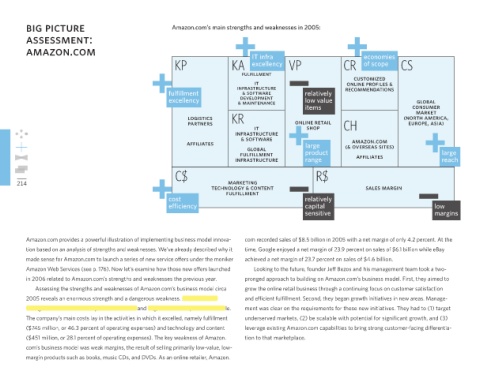

big picture Amazon.com’s main strengths and weaknesses in 2005:

assessment:

amazon.com IT infra economies

KP KA excellency VP CR of scope CS

fulfi llment customized

it online profi les &

infrastructure recommendations

fulfi llment & software relatively

development

excellency & maintenance low value global

items consumer

market

logistics KR (north america,

partners it online retail CH europe, asia)

shop

infrastructure

& software amazon.com

affi liates large

global (& overseas sites)

fulfi llment product affi liates large

infrastructure range reach

C$ R$

214 marketing

technology & content sales margin

fulfi llment

cost relatively

effi ciency capital low

sensitive margins

Amazon.com provides a powerful illustration of implementing business model innova- com recorded sales of $8.5 billion in 2005 with a net margin of only 4.2 percent. At the

tion based on an analysis of strengths and weaknesses. We’ve already described why it time, Google enjoyed a net margin of 23.9 percent on sales of $6.1 billion while eBay

made sense for Amazon.com to launch a series of new service offers under the moniker achieved a net margin of 23.7 percent on sales of $4.6 billion.

Amazon Web Services (see p. 176). Now let’s examine how those new offers launched Looking to the future, founder Jeff Bezos and his management team took a two-

in 2006 related to Amazon.com’s strengths and weaknesses the previous year. pronged approach to building on Amazon.com’s business model. First, they aimed to

Assessing the strengths and weaknesses of Amazon.com’s business model circa grow the online retail business through a continuing focus on customer satisfaction

2005 reveals an enormous strength and a dangerous weakness. Amazon.com’s and effi cient fulfi llment. Second, they began growth initiatives in new areas. Manage-

strength was its extraordinary customer reach and huge selection of products for sale. ment was clear on the requirements for these new initiatives. They had to (1) target

The company’s main costs lay in the activities in which it excelled, namely fulfi llment underserved markets, (2) be scalable with potential for signifi cant growth, and (3)

($745 million, or 46.3 percent of operating expenses) and technology and content leverage existing Amazon.com capabilities to bring strong customer-facing differentia-

($451 million, or 28.1 percent of operating expenses). The key weakness of Amazon. tion to that marketplace.

com’s business model was weak margins, the result of selling primarily low-value, low-

margin products such as books, music CDs, and DVDs. As an online retailer, Amazon.

!"#$%&'(%)*+(%,,---.18 /012013---2488-67