Page 223 -

P. 223

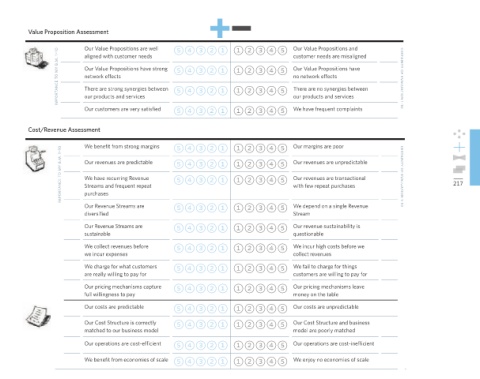

Value Proposition Assessment

Our Value Propositions are well 54321 12345 Our Value Propositions and

importance to my b.m. 1–10 Our Value Propositions have strong 54321 12345 Our Value Propositions have certainty of evaluation 1-10

aligned with customer needs

customer needs are misaligned

no network effects

network effects

There are no synergies between

There are strong synergies between

54321 12345

our products and services

We have frequent complaints

Our customers are very satisfi ed 54321 12345 our products and services

Cost/Revenue Assessment

We benefi t from strong margins 54321 12345 Our margins are poor

importance to my b.m. 1–10 Our revenues are predictable 54321 12345 Our revenues are unpredictable certainty of evaluation 1-10 217

Our revenues are transactional

We have recurring Revenue

54321 12345

Streams and frequent repeat

with few repeat purchases

purchases

Our Revenue Streams are 54321 12345 We depend on a single Revenue

diversifi ed Stream

Our Revenue Streams are 54321 12345 Our revenue sustainability is

sustainable questionable

We collect revenues before 54321 12345 We incur high costs before we

we incur expenses collect revenues

We charge for what customers 54321 12345 We fail to charge for things

are really willing to pay for customers are willing to pay for

Our pricing mechanisms capture 54321 12345 Our pricing mechanisms leave

full willingness to pay money on the table

Our costs are predictable 54321 12345 Our costs are unpredictable

Our Cost Structure is correctly 54321 12345 Our Cost Structure and business

matched to our business model model are poorly matched

Our operations are cost-effi cient 54321 12345 Our operations are cost-ineffi cient

We benefi t from economies of scale 54321 12345 We enjoy no economies of scale

!"#$%&'(%)*+(%,,---.19 /012013---2488-67