Page 107 - Aamir Rehman - Dubai & Co Global Strategies for Doing Business in the Gulf States-McGraw-Hill (2007)

P. 107

Here to Stay: GCC Market Attractiveness and Risks 91

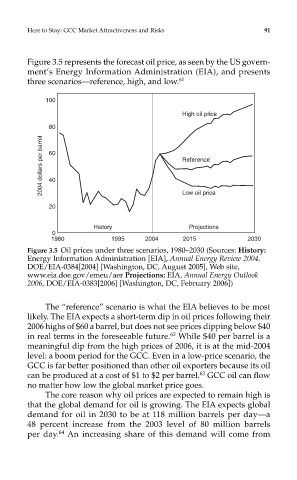

Figure 3.5 represents the forecast oil price, as seen by the US govern-

ment’s Energy Information Administration (EIA), and presents

three scenarios—reference, high, and low. 61

Figure 3.5 Oil prices under three scenarios, 1980–2030 (Sources: History:

Energy Information Administration [EIA], Annual Energy Review 2004,

DOE/EIA-0384[2004] [Washington, DC, August 2005], Web site,

www.eia.doe.gov/emeu/aer Projections: EIA, Annual Energy Outlook

2006, DOE/EIA-0383[2006] [Washington, DC, February 2006])

The “reference” scenario is what the EIA believes to be most

likely. The EIA expects a short-term dip in oil prices following their

2006 highs of $60 a barrel, but does not see prices dipping below $40

62

in real terms in the foreseeable future. While $40 per barrel is a

meaningful dip from the high prices of 2006, it is at the mid-2004

level: a boom period for the GCC. Even in a low-price scenario, the

GCC is far better positioned than other oil exporters because its oil

63

can be produced at a cost of $1 to $2 per barrel. GCC oil can flow

no matter how low the global market price goes.

The core reason why oil prices are expected to remain high is

that the global demand for oil is growing. The EIA expects global

demand for oil in 2030 to be at 118 million barrels per day—a

48 percent increase from the 2003 level of 80 million barrels

per day. 64 An increasing share of this demand will come from