Page 108 - Aamir Rehman - Dubai & Co Global Strategies for Doing Business in the Gulf States-McGraw-Hill (2007)

P. 108

92 Dubai & Co.

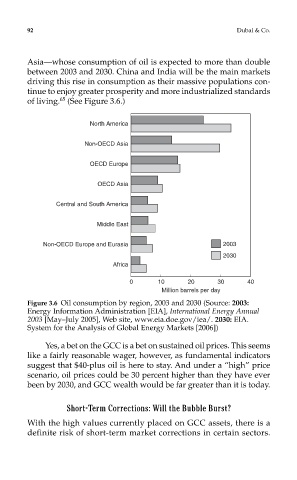

Asia—whose consumption of oil is expected to more than double

between 2003 and 2030. China and India will be the main markets

driving this rise in consumption as their massive populations con-

tinue to enjoy greater prosperity and more industrialized standards

65

of living. (See Figure 3.6.)

Figure 3.6 Oil consumption by region, 2003 and 2030 (Source: 2003:

Energy Information Administration [EIA], International Energy Annual

2003 [May–July 2005], Web site, www.eia.doe.gov/iea/. 2030: EIA.

System for the Analysis of Global Energy Markets [2006])

Yes, a bet on the GCC is a bet on sustained oil prices. This seems

like a fairly reasonable wager, however, as fundamental indicators

suggest that $40-plus oil is here to stay. And under a “high” price

scenario, oil prices could be 30 percent higher than they have ever

been by 2030, and GCC wealth would be far greater than it is today.

Short-Term Corrections: Will the Bubble Burst?

With the high values currently placed on GCC assets, there is a

definite risk of short-term market corrections in certain sectors.