Page 319 - E-Bussiness and E-Commerce Management Strategy, Implementation, and Practice

P. 319

M05_CHAF9601_04_SE_C05.QXD:D01_CHAF7409_04_SE_C01.QXD 16/4/09 11:12 Page 286

286 Part 2 Strategy and applications

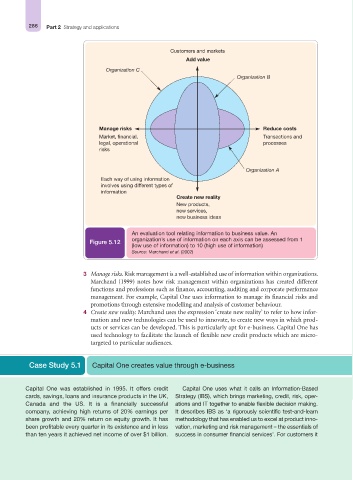

Customers and markets

Add value

Organization C

Organization B

Manage risks Reduce costs

Market, financial, Transactions and

legal, operational processes

risks

Organization A

Each way of using information

involves using different types of

information

Create new reality

New products,

new services,

new business ideas

An evaluation tool relating information to business value. An

organization’s use of information on each axis can be assessed from 1

Figure 5.12

(low use of information) to 10 (high use of information)

Source: Marchand et al. (2002)

3 Manage risks. Risk management is a well-established use of information within organizations.

Marchand (1999) notes how risk management within organizations has created different

functions and professions such as finance, accounting, auditing and corporate performance

management. For example, Capital One uses information to manage its financial risks and

promotions through extensive modelling and analysis of customer behaviour.

4 Create new reality. Marchand uses the expression ‘create new reality’ to refer to how infor-

mation and new technologies can be used to innovate, to create new ways in which prod-

ucts or services can be developed. This is particularly apt for e-business. Capital One has

used technology to facilitate the launch of flexible new credit products which are micro-

targeted to particular audiences.

Case Study 5.1 Capital One creates value through e-business

Capital One was established in 1995. It offers credit Capital One uses what it calls an Information-Based

cards, savings, loans and insurance products in the UK, Strategy (IBS), which brings marketing, credit, risk, oper-

Canada and the US. It is a financially successful ations and IT together to enable flexible decision making.

company, achieving high returns of 20% earnings per It describes IBS as ‘a rigorously scientific test-and-learn

share growth and 20% return on equity growth. It has methodology that has enabled us to excel at product inno-

been profitable every quarter in its existence and in less vation, marketing and risk management – the essentials of

than ten years it achieved net income of over $1 billion. success in consumer financial services’. For customers it