Page 187 - Finance for Non-Financial Managers

P. 187

Siciliano10.qxd 2/10/2003 3:07 PM Page 168

168

Variance:

Budget cost per

Actual cost per

Static

Favorable

Actual

unit produced

unit produced

Production in units Finance for Non-Financial Managers Budget (Unfavorable)

(100)

500

400

Direct labor $71.25 $65.00 $28,500 $32,500 $4,000

Variable overhead $160.00 $150.00 64,000 75,000 11,000

Total variable costs $92,500 $107,500 $15,000

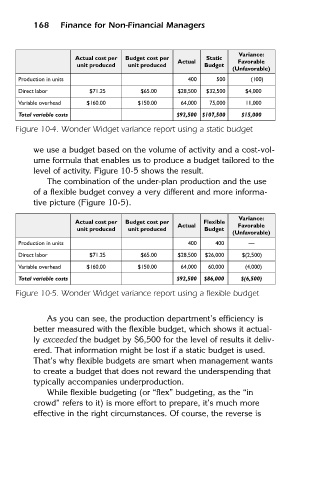

Figure 10-4. Wonder Widget variance report using a static budget

we use a budget based on the volume of activity and a cost-vol-

ume formula that enables us to produce a budget tailored to the

level of activity. Figure 10-5 shows the result.

The combination of the under-plan production and the use

of a flexible budget convey a very different and more informa-

tive picture (Figure 10-5).

Variance:

Actual cost per Budget cost per Flexible

Actual Favorable

unit produced unit produced Budget

(Unfavorable)

Production in units 400 400 —

Direct labor $71.25 $65.00 $28,500 $26,000 $(2,500)

Variable overhead $160.00 $150.00 64,000 60,000 (4,000)

Total variable costs $92,500 $86,000 $(6,500)

Figure 10-5. Wonder Widget variance report using a flexible budget

As you can see, the production department’s efficiency is

better measured with the flexible budget, which shows it actual-

ly exceeded the budget by $6,500 for the level of results it deliv-

ered. That information might be lost if a static budget is used.

That’s why flexible budgets are smart when management wants

to create a budget that does not reward the underspending that

typically accompanies underproduction.

While flexible budgeting (or “flex” budgeting, as the “in

crowd” refers to it) is more effort to prepare, it’s much more

effective in the right circumstances. Of course, the reverse is