Page 74 - Finance for Non-Financial Managers

P. 74

Siciliano04.qxd 2/8/2003 6:38 AM Page 55

55

The Income Statement: The Flow of Progress

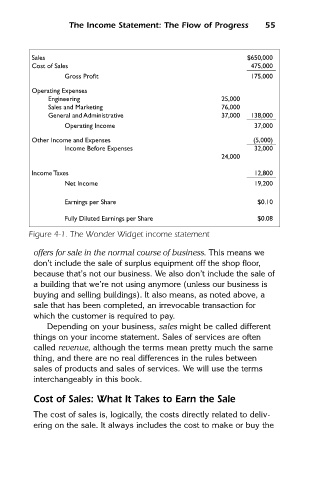

Sales

475,000

Cost of Sales

Gross Profit $650,000

175,000

Operating Expenses

Engineering 25,000

Sales and Marketing 76,000

General and Administrative 37,000 138,000

Operating Income 37,000

Other Income and Expenses (5,000)

Income Before Expenses 32,000

24,000

Income Taxes 12,800

Net Income 19,200

Earnings per Share $0.10

Fully Diluted Earnings per Share $0.08

Figure 4-1. The Wonder Widget income statement

offers for sale in the normal course of business. This means we

don’t include the sale of surplus equipment off the shop floor,

because that’s not our business. We also don’t include the sale of

a building that we’re not using anymore (unless our business is

buying and selling buildings). It also means, as noted above, a

sale that has been completed, an irrevocable transaction for

which the customer is required to pay.

Depending on your business, sales might be called different

things on your income statement. Sales of services are often

called revenue, although the terms mean pretty much the same

thing, and there are no real differences in the rules between

sales of products and sales of services. We will use the terms

interchangeably in this book.

Cost of Sales: What It Takes to Earn the Sale

The cost of sales is, logically, the costs directly related to deliv-

ering on the sale. It always includes the cost to make or buy the