Page 76 - Finance for Non-Financial Managers

P. 76

Siciliano04.qxd 2/8/2003 6:38 AM Page 57

The Income Statement: The Flow of Progress

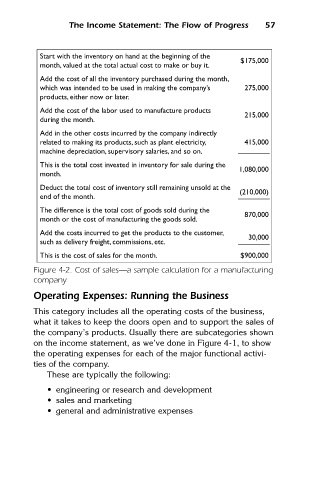

Start with the inventory on hand at the beginning of the

month, valued at the total actual cost to make or buy it.

Add the cost of all the inventory purchased during the month, $175,000 57

which was intended to be used in making the company’s 275,000

products, either now or later.

Add the cost of the labor used to manufacture products

215,000

during the month.

Add in the other costs incurred by the company indirectly

related to making its products, such as plant electricity, 415,000

machine depreciation, supervisory salaries, and so on.

This is the total cost invested in inventory for sale during the

1,080,000

month.

Deduct the total cost of inventory still remaining unsold at the

(210,000)

end of the month.

The difference is the total cost of goods sold during the

870,000

month or the cost of manufacturing the goods sold.

Add the costs incurred to get the products to the customer,

30,000

such as delivery freight, commissions, etc.

This is the cost of sales for the month. $900,000

Figure 4-2. Cost of sales—a sample calculation for a manufacturing

company

Operating Expenses: Running the Business

This category includes all the operating costs of the business,

what it takes to keep the doors open and to support the sales of

the company’s products. Usually there are subcategories shown

on the income statement, as we’ve done in Figure 4-1, to show

the operating expenses for each of the major functional activi-

ties of the company.

These are typically the following:

• engineering or research and development

• sales and marketing

• general and administrative expenses