Page 180 - Green Building Through Integrated Design

P. 180

156 INTEGRATED PROJECT MANAGEMENT—COST/BENEFIT ANALYSIS OF GREEN BUILDINGS

TABLE 8.7 ENERGY & ATMOSPHERE: CREDIT 2 ONSITE RENEWABLE ENERGY

LEED CREDIT SOLUTION LEED CREDIT SOLUTION

NON-LEED #1: PV SOLAR ELECTRIC #2: WIND TURBINE

BUILDING SYSTEM SYSTEM

Soft Cost Impacts None Additional MEP Additional MEP

engineering $20,000 engineering $20,000

Hard Cost Impacts None 1. Roofing upgrade for 1. Wind turbine system

PV system $50,000 $ 250,000

2. PV system $500,000 2. Tax incentives

3. Tax incentives $75,000

$150,000

Life-Cycle Benefits None Energy cost reduction Energy cost reduction

$20,000/year $15,000/year

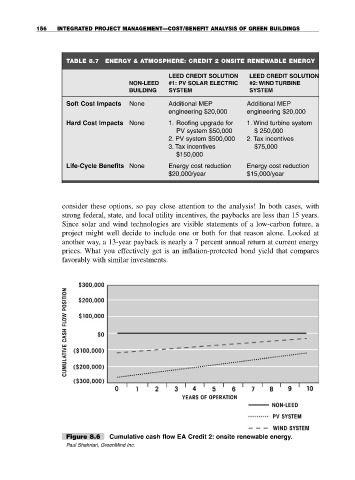

consider these options, so pay close attention to the analysis! In both cases, with

strong federal, state, and local utility incentives, the paybacks are less than 15 years.

Since solar and wind technologies are visible statements of a low-carbon future, a

project might well decide to include one or both for that reason alone. Looked at

another way, a 13-year payback is nearly a 7 percent annual return at current energy

prices. What you effectively get is an inflation-protected bond yield that compares

favorably with similar investments.

Figure 8.6 Cumulative cash flow EA Credit 2: onsite renewable energy.

Paul Shahriari, GreenMind Inc.