Page 118 - Introduction to Mineral Exploration

P. 118

5: FROM PROSPECT TO PREFEASIBILITY 101

30 30

25 25

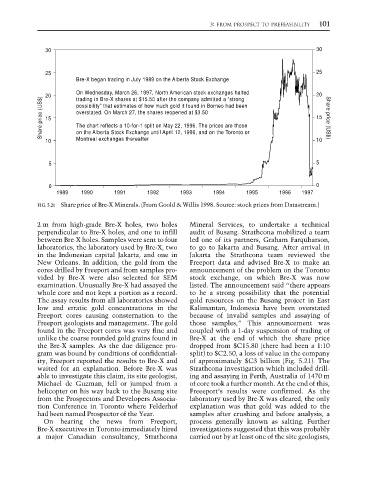

Bre-X began trading in July 1989 on the Alberta Stock Exchange

On Wednesday, March 26, 1997, North American stock exchanges halted 20

Share price (US$) 20 possibility” that estimates of how much gold it found in Borneo had been 15 Share price (US$)

trading in Bre-X shares at $15.50 after the company admitted a “strong

overstated. On March 27, the shares reopened at $3.50

15

The chart reflects a 10-for-1 split on May 22, 1996. The prices are those

Montreal exchanges thereafter

10 on the Alberta Stock Exchange until April 12, 1996, and on the Toronto or 10

5 5

0 0

1989 1990 1991 1992 1993 1994 1995 1996 1997

FIG. 5.21 Share price of Bre-X Minerals. (From Goold & Willis 1998. Source: stock prices from Datastream.)

2 m from high-grade Bre-X holes, two holes Mineral Services, to undertake a technical

perpendicular to Bre-X holes, and one to infill audit of Busang. Strathcona mobilized a team

between Bre-X holes. Samples were sent to four led one of its partners, Graham Farquharson,

laboratories, the laboratory used by Bre-X, two to go to Jakarta and Busang. After arrival in

in the Indonesian capital Jakarta, and one in Jakarta the Strathcona team reviewed the

New Orleans. In addition, the gold from the Freeport data and advised Bre-X to make an

cores drilled by Freeport and from samples pro- announcement of the problem on the Toronto

vided by Bre-X were also selected for SEM stock exchange, on which Bre-X was now

examination. Unusually Bre-X had assayed the listed. The announcement said “there appears

whole core and not kept a portion as a record. to be a strong possibility that the potential

The assay results from all laboratories showed gold resources on the Busang project in East

low and erratic gold concentrations in the Kalimantan, Indonesia have been overstated

Freeport cores causing consternation to the because of invalid samples and assaying of

Freeport geologists and management. The gold those samples,” This announcement was

found in the Freeport cores was very fine and coupled with a 1-day suspension of trading of

unlike the coarse rounded gold grains found in Bre-X at the end of which the share price

the Bre-X samples. As the due diligence pro- dropped from $C15.80 (there had been a 1:10

gram was bound by conditions of confidential- split) to $C2.50, a loss of value in the company

ity, Freeport reported the results to Bre-X and of approximately $C3 billion (Fig. 5.21). The

waited for an explanation. Before Bre-X was Strathcona investigation which included drill-

able to investigate this claim, its site geologist, ing and assaying in Perth, Australia of 1470 m

Michael de Guzman, fell or jumped from a of core took a further month. At the end of this,

helicopter on his way back to the Busang site Freeeport’s results were confirmed. As the

from the Prospectors and Developers Associa- laboratory used by Bre-X was cleared, the only

tion Conference in Toronto where Felderhof explanation was that gold was added to the

had been named Prospector of the Year. samples after crushing and before analysis, a

On hearing the news from Freeport, process generally known as salting. Further

Bre-X executives in Toronto immediately hired investigations suggested that this was probably

a major Canadian consultancy, Strathcona carried out by at least one of the site geologists,