Page 175 - Petroleum Geology

P. 175

152

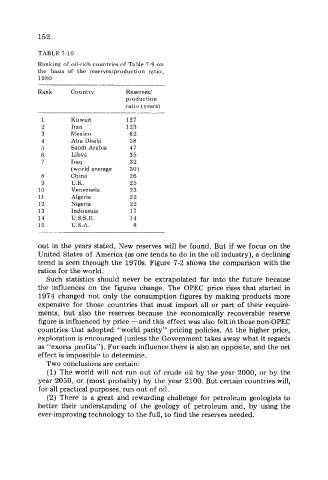

TABLE 7-10

Ranking of oil-rich countries of Table 7-9 on

the basis of the reserves/production ratio,

1980

Rank Country Reserves/

production

ratio (years)

Kuwait 127

Iran 123

Mexico 62

Abu Dhabi 58

Saudi Arabia 47

Libya 35

Iraq 32

(world average 30 1

a China 26

9 U.K. 25

10 Venezuela 23

11 Algeria 22

12 Nigeria 22

13 Indonesia 17

14 U.S.S.R. 14

15 U.S.A. 8

out in the years stated. New reserves will be found. But if we focus on the

United States of America (as one tends to do in the oil industry), a declining

trend is seen through the 1970s. Figure 7-2 shows the comparison with the

ratios for the world.

Such statistics should never be extrapolated far into the future because

the influences on the figures change. The OPEC price rises that started in

1974 changed not only the consumption figures by making products more

expensive for those countries that must import all or part of their require-

ments, but also the reserves because the economically recoverable reserve

figure is influenced by price - and this effect was also felt in those non-OPEC

countries that adopted “world parity” pricing policies. At the higher price,

exploration is encouraged (unless the Government takes away what it regards

as “excess profits”). For each influence there is also an opposite, and the net

effect is impossible to determine.

Two conclusions are certain:

(1) The world will not run out of crude oil by the year 2000, or by the

year 2050, or (most probably) by the year 2100. But certain countries will,

for all practical purposes, run out of oil.

(2) There is a great and rewarding challenge for petroleum geologists to

better their understanding of the geology of petroleum and, by using the

ever-improving technology to the full, to find the reserves needed.