Page 177 - Plant design and economics for chemical engineers

P. 177

COST ESTIMATION 151

~~~~~

(before depre:mtion charge) Net cash

flow from

the project

mcludmg

depreclotlon

write-off

for the

books

4 Investment = T

Total copltol

= W + A , + V

land

(wthout

Nonmonufocturmg

-I ond depreclotlon

flxed-copltol

choige must

uwestment

woe off

project

for

V over

Ax +

hfe of

project)

J

,

Totol copltol

\

Othe, ,,11,’ investment land)

(wthout

Investments \

-5\

copltol Net cash flow to copltol smk

source

and from the project

Other

capitol Input

Boids 1 \ stock

Preferred

Common stock

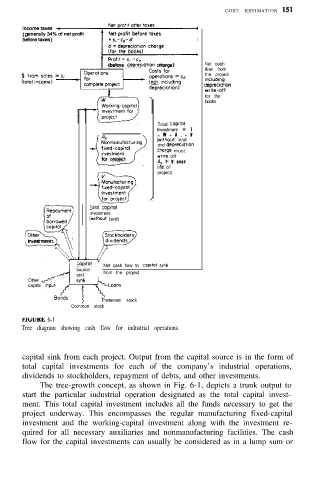

FlGURE 6-1

Tree diagram showing cash flow for industrial operations.

capital sink from each project. Output from the capital source is in the form of

total capital investments for each of the company’s industrial operations,

dividends to stockholders, repayment of debts, and other investments.

The tree-growth concept, as shown in Fig. 6-1, depicts a trunk output to

start the particular industrial operation designated as the total capital invest-

ment. This total capital investment includes all the funds necessary to get the

project underway. This encompasses the regular manufacturing fixed-capital

investment and the working-capital investment along with the investment re-

quired for all necessary auxiliaries and nonmanufacturing facilities. The cash

flow for the capital investments can usually be considered as in a lump sum or