Page 179 - Plant design and economics for chemical engineers

P. 179

COST ESTIMATION 153

Life of project eorn~ngs

A

Land, salvage, ond

Cumulotwe working copltal M

ccsh WCO”ery

posItlo”.

collars (+) 2Mt c umulotwe cash posltlon = (net proflt after

Net proflt

over total

llte of

project

Book value of investment

(wth straight-line deprectotlon)

Investment Zero-

time

Dollars (-1 hne

FIGURE 6-2

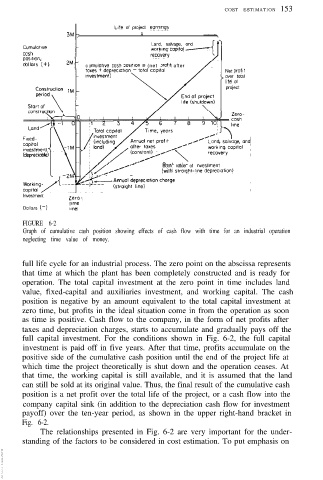

Graph of cumulative cash position showing effects of cash flow with time for an industrial operation

neglecting time value of money.

full life cycle for an industrial process. The zero point on the abscissa represents

that time at which the plant has been completely constructed and is ready for

operation. The total capital investment at the zero point in time includes land

value, fixed-capital and auxiliaries investment, and working capital. The cash

position is negative by an amount equivalent to the total capital investment at

zero time, but profits in the ideal situation come in from the operation as soon

as time is positive. Cash flow to the company, in the form of net profits after

taxes and depreciation charges, starts to accumulate and gradually pays off the

full capital investment. For the conditions shown in Fig. 6-2, the full capital

investment is paid off in five years. After that time, profits accumulate on the

positive side of the cumulative cash position until the end of the project life at

which time the project theoretically is shut down and the operation ceases. At

that time, the working capital is still available, and it is assumed that the land

can still be sold at its original value. Thus, the final result of the cumulative cash

position is a net profit over the total life of the project, or a cash flow into the

company capital sink (in addition to the depreciation cash flow for investment

payoff) over the ten-year period, as shown in the upper right-hand bracket in

Fig. 6-2.

The relationships presented in Fig. 6-2 are very important for the under-

standing of the factors to be considered in cost estimation. To put emphasis on