Page 108 -

P. 108

74 PART 2 • STRATEGY FORMULATION

Unilever recently sued Procter & Gamble (P&G) over that company’s corporate-

espionage activities to obtain the secrets of its Unilever hair-care business. After spending

$3 million to establish a team to find out about competitors in the domestic hair-care indus-

try, P&G allegedly took roughly 80 documents from garbage bins outside Unilever’s

Chicago offices. P&G produces Pantene and Head & Shoulders shampoos; Unilever has

hair-care brands such as ThermaSilk, Suave, Salon Selectives, and Finesse. Similarly,

Oracle Corp. recently admitted that detectives it hired paid janitors to go through

Microsoft Corp.’s garbage, looking for evidence to use in court.

Market Commonality and Resource Similarity

By definition, competitors are firms that offer similar products and services in the same

market. Markets can be geographic or product areas or segments. For example, in the

insurance industry the markets are broken down into commercial/consumer, health/life, or

Europe/Asia. Researchers use the terms market commonality and resource similarity to

study rivalry among competitors. Market commonality can be defined as the number and

significance of markets that a firm competes in with rivals. 11 Resource similarity is the

extent to which the type and amount of a firm’s internal resources are comparable to a

rival. 12 One way to analyze competitiveness between two or among several firms is to

investigate market commonality and resource similarity issues while looking for areas of

potential competitive advantage along each firm’s value chain.

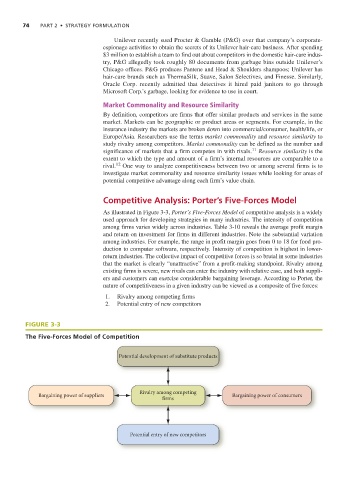

Competitive Analysis: Porter’s Five-Forces Model

As illustrated in Figure 3-3, Porter’s Five-Forces Model of competitive analysis is a widely

used approach for developing strategies in many industries. The intensity of competition

among firms varies widely across industries. Table 3-10 reveals the average profit margin

and return on investment for firms in different industries. Note the substantial variation

among industries. For example, the range in profit margin goes from 0 to 18 for food pro-

duction to computer software, respectively. Intensity of competition is highest in lower-

return industries. The collective impact of competitive forces is so brutal in some industries

that the market is clearly “unattractive” from a profit-making standpoint. Rivalry among

existing firms is severe, new rivals can enter the industry with relative ease, and both suppli-

ers and customers can exercise considerable bargaining leverage. According to Porter, the

nature of competitiveness in a given industry can be viewed as a composite of five forces:

1. Rivalry among competing firms

2. Potential entry of new competitors

FIGURE 3-3

The Five-Forces Model of Competition

Potential development of substitute products

Rivalry among competing

Bargaining power of suppliers Bargaining power of consumers

firms

Potential entry of new competitors