Page 109 -

P. 109

CHAPTER 3 • THE EXTERNAL ASSESSMENT 75

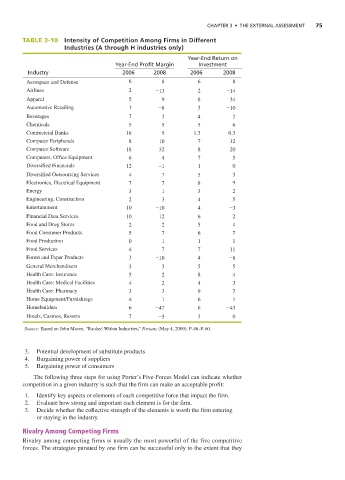

TABLE 3-10 Intensity of Competition Among Firms in Different

Industries (A through H industries only)

Year-End Return on

Year-End Profit Margin Investment

Industry 2006 2008 2006 2008

Aerospace and Defense 6 8 6 8

Airlines 2 -13 2 -14

Apparel 5 9 8 34

Automotive Retailing 1 -8 3 -10

Beverages 7 3 4 2

Chemicals 5 5 5 6

Commercial Banks 16 5 1.3 0.3

Computer Peripherals 8 10 7 12

Computer Software 18 32 8 20

Computers, Office Equipment 6 4 7 5

Diversified Financials 12 -1 1 0

Diversified Outsourcing Services 4 7 5 3

Electronics, Electrical Equipment 7 7 8 9

Energy 3 1 3 2

Engineering, Construction 2 3 4 5

Entertainment 10 -10 4 -3

Financial Data Services 10 12 6 2

Food and Drug Stores 2 2 5 4

Food Consumer Products 5 7 6 7

Food Production 0 1 1 1

Food Services 4 7 7 11

Forest and Paper Products 3 -10 4 -8

General Merchandisers 3 3 5 5

Health Care: Insurance 5 2 8 4

Health Care: Medical Facilities 4 2 4 3

Health Care: Pharmacy 3 3 9 7

Home Equipment/Furnishings 4 1 6 1

Homebuilders 6 -47 6 -43

Hotels, Casinos, Resorts 7 -5 3 0

Source: Based on John Moore, “Ranked Within Industries,” Fortune (May 4, 2009): F-46–F-60.

3. Potential development of substitute products

4. Bargaining power of suppliers

5. Bargaining power of consumers

The following three steps for using Porter’s Five-Forces Model can indicate whether

competition in a given industry is such that the firm can make an acceptable profit:

1. Identify key aspects or elements of each competitive force that impact the firm.

2. Evaluate how strong and important each element is for the firm.

3. Decide whether the collective strength of the elements is worth the firm entering

or staying in the industry.

Rivalry Among Competing Firms

Rivalry among competing firms is usually the most powerful of the five competitive

forces. The strategies pursued by one firm can be successful only to the extent that they