Page 397 -

P. 397

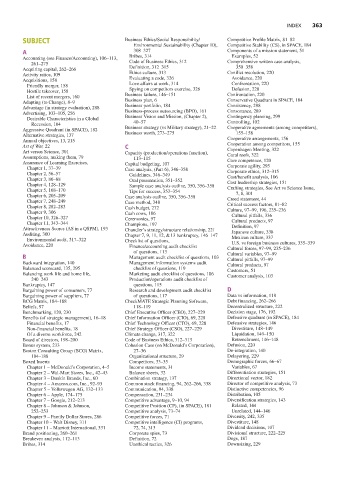

INDEX 363

SUBJECT Business Ethics/Social Responsibility/ Competitive Profile Matrix, 81–82

Environmental Sustainability (Chapter 10), Competitive Stability (CS), in SPACE, 184

A 308–327 Components of a mission statement, 51

Accounting (see Finance/Accounting), 106–113, Bribes, 314 Examples, 52

261–275 Code of Business Ethics, 312 Comprehensive written case analysis,

Acquiring capital, 262–266 Definition, 312–315 350–358

Activity ratios, 109 Ethics culture, 313 Conflict resolution, 220

Acquisitions, 158 Evaluating a code, 326 Avoidance, 220

Friendly merger, 158 Love affairs at work, 314 Confrontation, 220

Hostile takeover, 158 Spying on competitors exercise, 326 Defusion, 220

List of recent mergers, 160 Business failure, 146–151 Confrontation, 220

Adapting (to Change), 8–9 Business plan, 6 Conservative Quadrant in SPACE, 184

Advantage (in strategy evaluation), 288 Business portfolio, 184 Consistency, 288

Advertising, 103–105, 256 Business-process outsourcing (BPO), 161 Consonance, 289

Desirable Characteristics in a Global Business Vision and Mission, (Chapter 2), Contingency planning, 299

Recession, 104 40–57 Controlling, 102

Aggressive Quadrant (in SPACE), 182 Business strategy (vs Military strategy), 21–22 Cooperative agreements (among competitors),

Alternative strategies, 137 Business worth, 273–275 155–158

Annual objectives, 13, 215 Cooperative arrangements, 156

Art of War, 22 C Cooperation among competitors, 155

Art versus Science, 301 Capacity (production/operations function), Copenhagen Meeting, 322

Assumptions, making them, 79 113–115 Coral reefs, 322

Assurance of Learning Exercises, Capital budgeting, 107 Core competence, 120

Chapter 1, 37–39 Case analysis, (Part 6), 346–358 Corporate agility, 295

Chapter 2, 56–57 Guidelines, 346–349 Corporate ethics, 312–315

Chapter 3, 86–88 Oral presentation, 351–352 Cost/benefit analysis, 106

Chapter 4, 128–129 Sample case analysis outline, 350, 356–358 Cost leadership strategies, 151

Chapter 5, 168–170 Tips for success, 353–354 Crafting strategies, See Art vs Science Issue,

Chapter 6, 205–209 Case analysis outline, 350, 356–358 7, 8, 301

Chapter 7, 248–249 Case method, 348 Creed statement, 44

Chapter 8, 282–283 Cash budget, 272 Critical success factors, 81–82

Chapter 9, 306 Cash cows, 186 Culture, 97–99, 196, 235–236

Chapter 10, 326–327 Ceremonies, 97 Cultural pitfalls, 336

Chapter 11, 343–344 Champions, 197 Cultural products, 97

Attractiveness Scores (AS in a QSPM), 193 Chandler’s strategy/structure relationship, 221 Definition, 97

Auditing, 300 Chapter 7, 9, 11, 12, &13 bankruptcy, 146–147 Japanese culture, 338

Environmental audit, 317–322 Checklist of questions, Mexican culture, 337

U.S. vs foreign business cultures, 335–339

Avoidance, 220 Finance/accounting audit checklist Cultural forces, 97–99, 235–236

of questions, 113 Cultural variables, 97–99

B Management audit checklist of questions, 103 Cultural pitfalls, 97–99

Backward integration, 140 Management information systems audit Cultural products, 97

Balanced scorecard, 135, 295 checklist of questions, 119 Customers, 51

Balancing work life and home life, Marketing audit checklist of questions, 106 Customer analysis, 103

240–243 Production/operations audit checklist of

Bankruptcy, 147 questions, 115

Bargaining power of consumers, 77 Research and development audit checklist D

Bargaining power of suppliers, 77 of questions, 117 Data vs information, 118

BCG Matrix, 184–188 CheckMATE Strategic Planning Software, Debt financing, 262–266

Beliefs, 97 118–119 Decentralized structure, 222

Benchmarking, 120, 230 Chief Executive Officer (CEO), 227–229 Decision stage, 176, 192

Benefits (of strategic management), 16–18 Chief Information Officer (CIO), 69, 228 Defensive quadrant (in SPACE), 184

Financial benefits, 17 Chief Technology Officer (CTO), 69, 228 Defensive strategies, 146

Non-financial benefits, 18 Chief Strategy Officer (CSO), 227–229 Divestiture, 148–149

Of a diverse workforce, 242 Climate change, 317, 322 Liquidation, 149–150

Board of directors, 198–200 Code of Business Ethics, 312–313 Retrenchment, 146–148

Bonus system, 233 Cohesion Case (on McDonald’s Corporation), Defusion, 220

Boston Consulting Group (BCG) Matrix, 27–36 De-integration, 140

184–188 Organizational structure, 29 Delayering, 229

Boxed Inserts Competitors, 33–35 Demographic forces, 66–67

Chapter 1 – McDonald’s Corporation, 4–5 Income statements, 31 Variables, 67

Chapter 2 – Wal-Mart Stores, Inc., 42–43 Balance sheets, 32 Differentiation strategies, 151

Chapter 3 – Dunkin Brands, Inc., 60 Combination strategy, 137 Directional vector, 182

Chapter 4 – Amazon.com, Inc., 92–93 Common stock financing, 94, 262–266, 338 Director of competitive analysis, 73

Chapter 5 – Volkswagen AG, 132–133 Communication, 94, 338 Distinctive competencies, 96

Chapter 6 – Apple, 174–175 Compensation, 231–234 Distribution, 105

Chapter 7 – Google, 212–213 Competitive advantage, 9–10, 94 Diversification strategies, 143

Chapter 8 – Johnson & Johnson, Competitive Position (CP), (in SPACE), 181 Related, 144

252–253 Competitive analysis, 73–74 Unrelated, 144–146

Chapter 9 – Family Dollar Stores, 286 Competitive forces, 71 Diversity, 242, 335

Chapter 10 – Walt Disney, 311 Competitive intelligence (CI) programs, Divestiture, 148

Chapter 11 – Marriott International, 331 72, 74, 313 Dividend decisions, 107

Brand positioning, 260–261 Corporate spies, 73 Divisional structure, 222–225

Breakeven analysis, 112–113 Definition, 72 Dogs, 187

Bribes, 314 Unethical tactics, 326 Downsizing, 229