Page 491 -

P. 491

CASE 8 • MACY’S, INC. — 2009 87

Macy’s recently launched a series of breakthrough brand ads featuring more than a

dozen design celebrities behind unique merchandise sold in their stores and online. These

celebrities ranged from Martha Stewart and Donald Trump to Usher, Jessica Simpson, Tyler

Florence, Sean Combs, and Kenneth Cole. The campaign ads, which depict the celebrities

interacting inside Macy’s, are planned to continue into the future with new faces and themes.

Financial Performance

Macy’s has adopted the following financial objectives:

• To accelerate comparable store sales growth.

• To continue to increase the company’s profitability levels (earnings before interest,

taxes, depreciation, and amortization) as a percentage of sales to a level of 14 percent

to 15 percent.

• To effectively use excess cash flow through a combination of strategic growth oppor-

tunities and stock buybacks.

• To grow earnings per share while increasing return on gross investment.

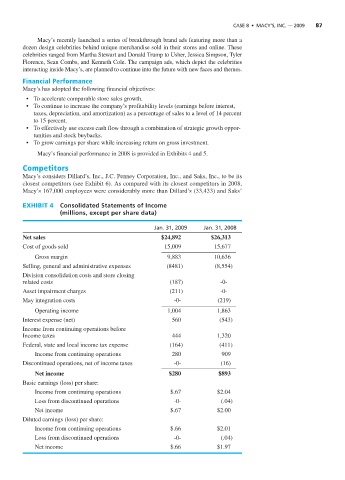

Macy’s financial performance in 2008 is provided in Exhibits 4 and 5.

Competitors

Macy’s considers Dillard’s, Inc., J.C. Penney Corporation, Inc., and Saks, Inc., to be its

closest competitors (see Exhibit 6). As compared with its closest competitors in 2008,

Macy’s 167,000 employees were considerably more than Dillard’s (33,433) and Saks’

EXHIBIT 4 Consolidated Statements of Income

(millions, except per share data)

Jan. 31, 2009 Jan. 31, 2008

Net sales $24,892 $26,313

Cost of goods sold 15,009 15,677

Gross margin 9,883 10,636

Selling, general and administrative expenses (8481) (8,554)

Division consolidation costs and store closing

related costs (187) -0-

Asset impairment charges (211) -0-

May integration costs -0- (219)

Operating income 1,004 1,863

Interest expense (net) 560 (543)

Income from continuing operations before

Income taxes 444 1,320

Federal, state and local income tax expense (164) (411)

Income from continuing operations 280 909

Discontinued operations, net of income taxes -0- (16)

Net income $280 $893

Basic earnings (loss) per share:

Income from continuing operations $.67 $2.04

Loss from discontinued operations -0- (.04)

Net income $.67 $2.00

Diluted earnings (loss) per share:

Income from continuing operations $.66 $2.01

Loss from discontinued operations -0- (.04)

Net income $.66 $1.97