Page 297 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 297

Chapter 6. Employee Benefits and Perquisites 283

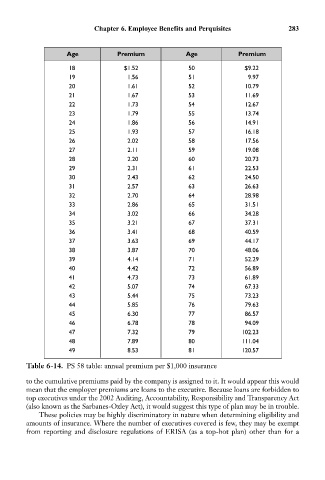

Age Premium Age Premium

18 $1.52 50 $9.22

19 1.56 51 9.97

20 1.61 52 10.79

21 1.67 53 11.69

22 1.73 54 12.67

23 1.79 55 13.74

24 1.86 56 14.91

25 1.93 57 16.18

26 2.02 58 17.56

27 2.11 59 19.08

28 2.20 60 20.73

29 2.31 61 22.53

30 2.43 62 24.50

31 2.57 63 26.63

32 2.70 64 28.98

33 2.86 65 31.51

34 3.02 66 34.28

35 3.21 67 37.31

36 3.41 68 40.59

37 3.63 69 44.17

38 3.87 70 48.06

39 4.14 71 52.29

40 4.42 72 56.89

41 4.73 73 61.89

42 5.07 74 67.33

43 5.44 75 73.23

44 5.85 76 79.63

45 6.30 77 86.57

46 6.78 78 94.09

47 7.32 79 102.23

48 7.89 80 111.04

49 8.53 81 120.57

Table 6-14. PS 58 table: annual premium per $1,000 insurance

to the cumulative premiums paid by the company is assigned to it. It would appear this would

mean that the employer premiums are loans to the executive. Because loans are forbidden to

top executives under the 2002 Auditing, Accountability, Responsibility and Transparency Act

(also known as the Sarbanes-Oxley Act), it would suggest this type of plan may be in trouble.

These policies may be highly discriminatory in nature when determining eligibility and

amounts of insurance. Where the number of executives covered is few, they may be exempt

from reporting and disclosure regulations of ERISA (as a top-hot plan) other than for a