Page 293 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 293

Chapter 6. Employee Benefits and Perquisites 279

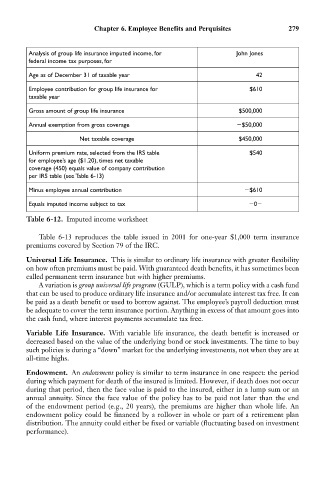

Analysis of group life insurance imputed income, for John Jones

federal income tax purposes, for

Age as of December 31 of taxable year 42

Employee contribution for group life insurance for $610

taxable year

Gross amount of group life insurance $500,000

Annual exemption from gross coverage $50,000

Net taxable coverage $450,000

Uniform premium rate, selected from the IRS table $540

for employee’s age ($1.20), times net taxable

coverage (450) equals value of company contribution

per IRS table (see Table 6-13)

Minus employee annual contribution $610

Equals imputed income subject to tax 0

Table 6-12. Imputed income worksheet

Table 6-13 reproduces the table issued in 2001 for one-year $1,000 term insurance

premiums covered by Section 79 of the IRC.

Universal Life Insurance. This is similar to ordinary life insurance with greater flexibility

on how often premiums must be paid. With guaranteed death benefits, it has sometimes been

called permanent term insurance but with higher premiums.

A variation is group universal life program (GULP), which is a term policy with a cash fund

that can be used to produce ordinary life insurance and/or accumulate interest tax free. It can

be paid as a death benefit or used to borrow against. The employee’s payroll deduction must

be adequate to cover the term insurance portion. Anything in excess of that amount goes into

the cash fund, where interest payments accumulate tax free.

Variable Life Insurance. With variable life insurance, the death benefit is increased or

decreased based on the value of the underlying bond or stock investments. The time to buy

such policies is during a “down” market for the underlying investments, not when they are at

all-time highs.

Endowment. An endowment policy is similar to term insurance in one respect: the period

during which payment for death of the insured is limited. However, if death does not occur

during that period, then the face value is paid to the insured, either in a lump sum or an

annual annuity. Since the face value of the policy has to be paid not later than the end

of the endowment period (e.g., 20 years), the premiums are higher than whole life. An

endowment policy could be financed by a rollover in whole or part of a retirement plan

distribution. The annuity could either be fixed or variable (fluctuating based on investment

performance).