Page 298 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 298

284 The Complete Guide to Executive Compensation

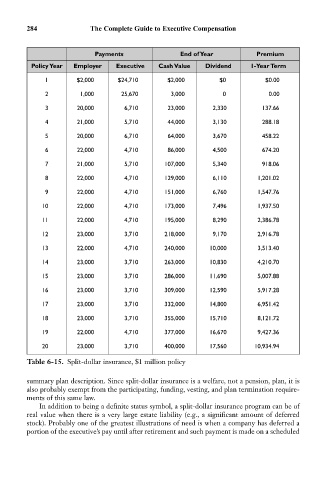

Payments End of Year Premium

Policy Year Employer Executive Cash Value Dividend 1-Year Term

1 $2,000 $24,710 $2,000 $0 $0.00

2 1,000 25,670 3,000 0 0.00

3 20,000 6,710 23,000 2,330 137.66

4 21,000 5,710 44,000 3,130 288.18

5 20,000 6,710 64,000 3,670 458.22

6 22,000 4,710 86,000 4,500 674.20

7 21,000 5,710 107,000 5,340 918.06

8 22,000 4,710 129,000 6,110 1,201.02

9 22,000 4,710 151,000 6,760 1,547.76

10 22,000 4,710 173,000 7,496 1,937.50

11 22,000 4,710 195,000 8,290 2,386.78

12 23,000 3,710 218,000 9,170 2,916.78

13 22,000 4,710 240,000 10,000 3,513.40

14 23,000 3,710 263,000 10,830 4,210.70

15 23,000 3,710 286,000 11,690 5,007.88

16 23,000 3,710 309,000 12,590 5,917.28

17 23,000 3,710 332,000 14,800 6,951.42

18 23,000 3,710 355,000 15,710 8,121.72

19 22,000 4,710 377,000 16,670 9,427.36

20 23,000 3,710 400,000 17,560 10,934.94

Table 6-15. Split-dollar insurance, $1 million policy

summary plan description. Since split-dollar insurance is a welfare, not a pension, plan, it is

also probably exempt from the participating, funding, vesting, and plan termination require-

ments of this same law.

In addition to being a definite status symbol, a split-dollar insurance program can be of

real value when there is a very large estate liability (e.g., a significant amount of deferred

stock). Probably one of the greatest illustrations of need is when a company has deferred a

portion of the executive’s pay until after retirement and such payment is made on a scheduled