Page 294 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 294

280 The Complete Guide to Executive Compensation

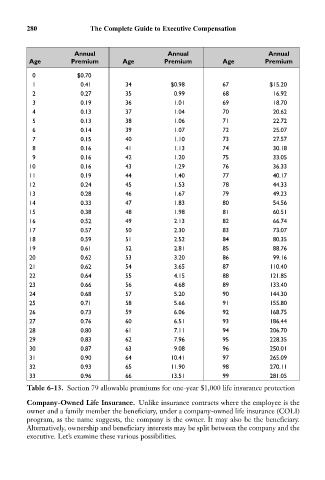

Annual Annual Annual

Age Premium Age Premium Age Premium

0 $0.70

1 0.41 34 $0.98 67 $15.20

2 0.27 35 0.99 68 16.92

3 0.19 36 1.01 69 18.70

4 0.13 37 1.04 70 20.62

5 0.13 38 1.06 71 22.72

6 0.14 39 1.07 72 25.07

7 0.15 40 1.10 73 27.57

8 0.16 41 1.13 74 30.18

9 0.16 42 1.20 75 33.05

10 0.16 43 1.29 76 36.33

11 0.19 44 1.40 77 40.17

12 0.24 45 1.53 78 44.33

13 0.28 46 1.67 79 49.23

14 0.33 47 1.83 80 54.56

15 0.38 48 1.98 81 60.51

16 0.52 49 2.13 82 66.74

17 0.57 50 2.30 83 73.07

18 0.59 51 2.52 84 80.35

19 0.61 52 2.81 85 88.76

20 0.62 53 3.20 86 99.16

21 0.62 54 3.65 87 110.40

22 0.64 55 4.15 88 121.85

23 0.66 56 4.68 89 133.40

24 0.68 57 5.20 90 144.30

25 0.71 58 5.66 91 155.80

26 0.73 59 6.06 92 168.75

27 0.76 60 6.51 93 186.44

28 0.80 61 7.11 94 206.70

29 0.83 62 7.96 95 228.35

30 0.87 63 9.08 96 250.01

31 0.90 64 10.41 97 265.09

32 0.93 65 11.90 98 270.11

33 0.96 66 13.51 99 281.05

Table 6-13. Section 79 allowable premiums for one-year $1,000 life insurance protection

Company-Owned Life Insurance. Unlike insurance contracts where the employee is the

owner and a family member the beneficiary, under a company-owned life insurance (COLI)

program, as the name suggests, the company is the owner. It may also be the beneficiary.

Alternatively, ownership and beneficiary interests may be split between the company and the

executive. Let’s examine these various possibilities.