Page 368 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 368

354 The Complete Guide to Executive Compensation

If the incentive is to be paid in company stock, it is important to determine whether or

not the SEC will consider it an acquisition for purpose of the insider six-month rule. Clearly,

a subsequent sale is considered a sale by the SEC.

Whether the individual receives the award in cash or something other than cash (e.g.,

company stock), the tax treatment is the same: income tax on the value of the award on the

date when received. (See Chapter 3 for more on deferred income.)

The individual award must relate to individual performance—especially for the better

performer. When the award does not appear to adequately reflect performance, the plan is in

trouble. In other words, if a plan gives essentially the same award to both the marginal and

the outstanding performer, two things happen. The marginal performer is no longer

attentive to requests to improve performance; the outstanding performer will either lower

future performance to meet the award level (by increasing off-the-job activities for either

intrinsic or extrinsic compensation) or be receptive to job offers from other companies. Most

companies would find these two results undesirable.

WHAT SHOULD BE MEASURED?

The factors selected for measurement must support the company’s business strategy. (Chapter 2

focused on performance measurements both organizationally and individually.) As one drills

down into the organization, a clear line of sight must be maintained between performance

measurements and business objectives. In addition, performance targets throughout the

organization should be of equal stretch or difficulty. The measurements and how they relate to

business objectives must be clearly communicated to all bonus candidates and to shareholders.

Organizational Performance

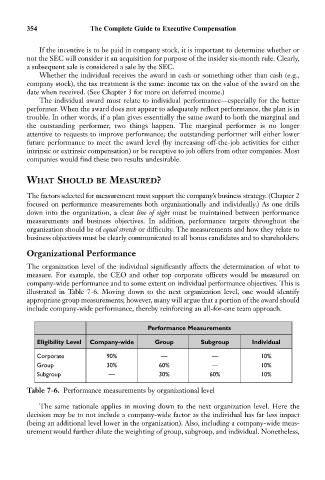

The organization level of the individual significantly affects the determination of what to

measure. For example, the CEO and other top corporate officers would be measured on

company-wide performance and to some extent on individual performance objectives. This is

illustrated in Table 7-6. Moving down to the next organization level, one would identify

appropriate group measurements; however, many will argue that a portion of the award should

include company-wide performance, thereby reinforcing an all-for-one team approach.

Performance Measurements

Eligibility Level Company-wide Group Subgroup Individual

Corporate 90% — — 10%

Group 30% 60% — 10%

Subgroup — 30% 60% 10%

Table 7-6. Performance measurements by organizational level

The same rationale applies in moving down to the next organization level. Here the

decision may be to not include a company-wide factor as the individual has far less impact

(being an additional level lower in the organization). Also, including a company-wide meas-

urement would further dilute the weighting of group, subgroup, and individual. Nonetheless,