Page 373 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 373

Chapter 7. Short-Term Incentives 359

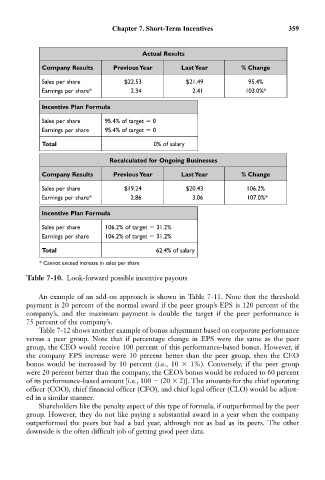

Actual Results

Company Results Previous Year Last Year % Change

Sales per share $22.53 $21.49 95.4%

Earnings per share* 2.34 2.41 103.0%*

Incentive Plan Formula

Sales per share 95.4% of target 0

Earnings per share 95.4% of target 0

Total 0% of salary

Recalculated for Ongoing Businesses

Company Results Previous Year Last Year % Change

Sales per share $19.24 $20.43 106.2%

Earnings per share* 2.86 3.06 107.0%*

Incentive Plan Formula

Sales per share 106.2% of target 31.2%

Earnings per share 106.2% of target 31.2%

Total 62.4% of salary

* Cannot exceed increase in sales per share

Table 7-10. Look-forward possible incentive payouts

An example of an add-on approach is shown in Table 7-11. Note that the threshold

payment is 20 percent of the normal award if the peer group’s EPS is 120 percent of the

company’s, and the maximum payment is double the target if the peer performance is

75 percent of the company’s.

Table 7-12 shows another example of bonus adjustment based on corporate performance

versus a peer group. Note that if percentage change in EPS were the same as the peer

group, the CEO would receive 100 percent of this performance-based bonus. However, if

the company EPS increase were 10 percent better than the peer group, then the CEO

bonus would be increased by 10 percent (i.e., 10 1%). Conversely, if the peer group

were 20 percent better than the company, the CEO’s bonus would be reduced to 60 percent

of its performance-based amount [i.e., 100 (20 2)]. The amounts for the chief operating

officer (COO), chief financial officer (CFO), and chief legal officer (CLO) would be adjust-

ed in a similar manner.

Shareholders like the penalty aspect of this type of formula, if outperformed by the peer

group. However, they do not like paying a substantial award in a year when the company

outperformed the peers but had a bad year, although not as bad as its peers. The other

downside is the often difficult job of getting good peer data.