Page 374 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 374

360 The Complete Guide to Executive Compensation

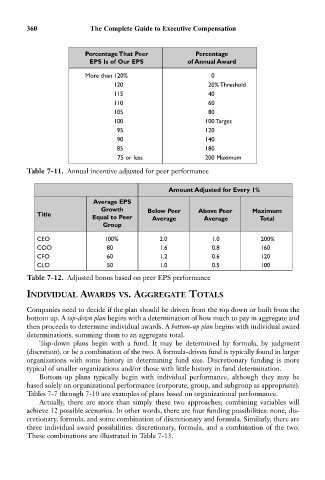

Percentage That Peer Percentage

EPS Is of Our EPS of Annual Award

More than 120% 0

120 20% Threshold

115 40

110 60

105 80

100 100 Target

95 120

90 140

85 180

75 or less 200 Maximum

Table 7-11. Annual incentive adjusted for peer performance

Amount Adjusted for Every 1%

Average EPS

Growth Below Peer Above Peer Maximum

Title

Equal to Peer Average Average Total

Group

CEO 100% 2.0 1.0 200%

COO 80 1.6 0.8 160

CFO 60 1.2 0.6 120

CLO 50 1.0 0.5 100

Table 7-12. Adjusted bonus based on peer EPS performance

INDIVIDUAL AWARDS VS. AGGREGATE TOTALS

Companies need to decide if the plan should be driven from the top down or built from the

bottom up. A top-down plan begins with a determination of how much to pay in aggregate and

then proceeds to determine individual awards. A bottom-up plan begins with individual award

determinations, summing them to an aggregate total.

Top-down plans begin with a fund. It may be determined by formula, by judgment

(discretion), or be a combination of the two. A formula-driven fund is typically found in larger

organizations with some history in determining fund size. Discretionary funding is more

typical of smaller organizations and/or those with little history in fund determination.

Bottom-up plans typically begin with individual performance, although they may be

based solely on organizational performance (corporate, group, and subgroup as appropriate).

Tables 7-7 through 7-10 are examples of plans based on organizational performance.

Actually, there are more than simply these two approaches; combining variables will

achieve 12 possible scenarios. In other words, there are four funding possibilities: none, dis-

cretionary, formula, and some combination of discretionary and formula. Similarly, there are

three individual award possibilities: discretionary, formula, and a combination of the two.

These combinations are illustrated in Table 7-13.