Page 440 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 440

426 The Complete Guide to Executive Compensation

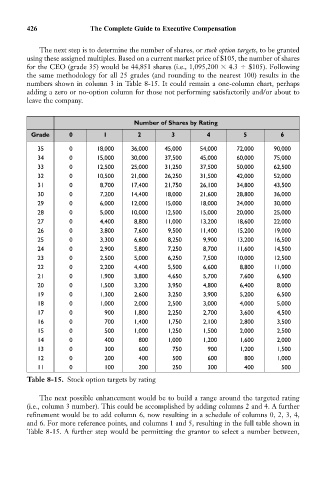

The next step is to determine the number of shares, or stock option targets, to be granted

using these assigned multiples. Based on a current market price of $105, the number of shares

for the CEO (grade 35) would be 44,851 shares (i.e., 1,095,200 4.3 $105). Following

the same methodology for all 25 grades (and rounding to the nearest 100) results in the

numbers shown in column 3 in Table 8-15. It could remain a one-column chart, perhaps

adding a zero or no-option column for those not performing satisfactorily and/or about to

leave the company.

Number of Shares by Rating

Grade 0 1 2 3 4 5 6

35 0 18,000 36,000 45,000 54,000 72,000 90,000

34 0 15,000 30,000 37,500 45,000 60,000 75,000

33 0 12,500 25,000 31,250 37,500 50,000 62,500

32 0 10,500 21,000 26,250 31,500 42,000 52,000

31 0 8,700 17,400 21,750 26,100 34,800 43,500

30 0 7,200 14,400 18,000 21,600 28,800 36,000

29 0 6,000 12,000 15,000 18,000 24,000 30,000

28 0 5,000 10,000 12,500 15,000 20,000 25,000

27 0 4,400 8,800 11,000 13,200 18,600 22,000

26 0 3,800 7,600 9,500 11,400 15,200 19,000

25 0 3,300 6,600 8,250 9,900 13,200 16,500

24 0 2,900 5,800 7,250 8,700 11,600 14,500

23 0 2,500 5,000 6,250 7,500 10,000 12,500

22 0 2,200 4,400 5,500 6,600 8,800 11,000

21 0 1,900 3,800 4,650 5,700 7,600 6,500

20 0 1,500 3,200 3,950 4,800 6,400 8,000

19 0 1,300 2,600 3,250 3,900 5,200 6,500

18 0 1,000 2,000 2,500 3,000 4,000 5,000

17 0 900 1,800 2,250 2,700 3,600 4,500

16 0 700 1,400 1,750 2,100 2,800 3,500

15 0 500 1,000 1,250 1,500 2,000 2,500

14 0 400 800 1,000 1,200 1,600 2,000

13 0 300 600 750 900 1,200 1,500

12 0 200 400 500 600 800 1,000

11 0 100 200 250 300 400 500

Table 8-15. Stock option targets by rating

The next possible enhancement would be to build a range around the targeted rating

(i.e., column 3 number). This could be accomplished by adding columns 2 and 4. A further

refinement would be to add column 6, now resulting in a schedule of columns 0, 2, 3, 4,

and 6. For more reference points, and columns 1 and 5, resulting in the full table shown in

Table 8-15. A further step would be permitting the grantor to select a number between,