Page 748 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 748

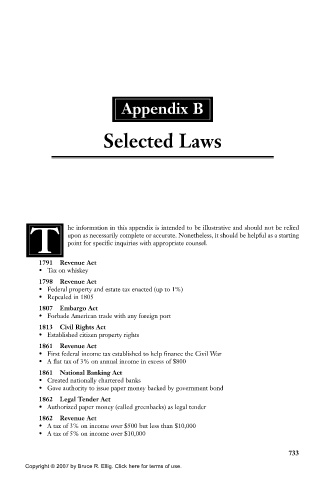

Appendix B

Selected Laws

T he information in this appendix is intended to be illustrative and should not be relied

upon as necessarily complete or accurate. Nonetheless, it should be helpful as a starting

point for specific inquiries with appropriate counsel.

1791 Revenue Act

• Tax on whiskey

1798 Revenue Act

• Federal property and estate tax enacted (up to 1%)

• Repealed in 1805

1807 Embargo Act

• Forbade American trade with any foreign port

1813 Civil Rights Act

• Established citizen property rights

1861 Revenue Act

• First federal income tax established to help finance the Civil War

• A flat tax of 3% on annual income in excess of $800

1861 National Banking Act

• Created nationally chartered banks

• Gave authority to issue paper money backed by government bond

1862 Legal Tender Act

• Authorized paper money (called greenbacks) as legal tender

1862 Revenue Act

• A tax of 3% on income over $500 but less than $10,000

• A tax of 5% on income over $10,000

733

Copyright © 2007 by Bruce R. Ellig. Click here for terms of use.