Page 750 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 750

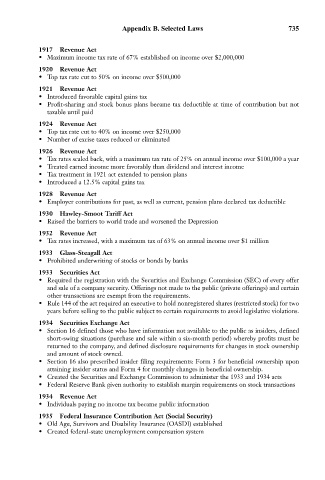

Appendix B. Selected Laws 735

1917 Revenue Act

• Maximum income tax rate of 67% established on income over $2,000,000

1920 Revenue Act

• Top tax rate cut to 50% on income over $500,000

1921 Revenue Act

• Introduced favorable capital gains tax

• Profit-sharing and stock bonus plans became tax deductible at time of contribution but not

taxable until paid

1924 Revenue Act

• Top tax rate cut to 40% on income over $250,000

• Number of excise taxes reduced or eliminated

1926 Revenue Act

• Tax rates scaled back, with a maximum tax rate of 25% on annual income over $100,000 a year

• Treated earned income more favorably than dividend and interest income

• Tax treatment in 1921 act extended to pension plans

• Introduced a 12.5% capital gains tax

1928 Revenue Act

• Employer contributions for past, as well as current, pension plans declared tax deductible

1930 Hawley-Smoot Tariff Act

• Raised the barriers to world trade and worsened the Depression

1932 Revenue Act

• Tax rates increased, with a maximum tax of 63% on annual income over $1 million

1933 Glass-Steagall Act

• Prohibited underwriting of stocks or bonds by banks

1933 Securities Act

• Required the registration with the Securities and Exchange Commission (SEC) of every offer

and sale of a company security. Offerings not made to the public (private offerings) and certain

other transactions are exempt from the requirements.

• Rule 144 of the act required an executive to hold nonregistered shares (restricted stock) for two

years before selling to the public subject to certain requirements to avoid legislative violations.

1934 Securities Exchange Act

• Section 16 defined those who have information not available to the public as insiders, defined

short-swing situations (purchase and sale within a six-month period) whereby profits must be

returned to the company, and defined disclosure requirements for changes in stock ownership

and amount of stock owned.

• Section 16 also prescribed insider filing requirements: Form 3 for beneficial ownership upon

attaining insider status and Form 4 for monthly changes in beneficial ownership.

• Created the Securities and Exchange Commission to administer the 1933 and 1934 acts

• Federal Reserve Bank given authority to establish margin requirements on stock transactions

1934 Revenue Act

• Individuals paying no income tax became public information

1935 Federal Insurance Contribution Act (Social Security)

• Old Age, Survivors and Disability Insurance (OASDI) established

• Created federal-state unemployment compensation system