Page 755 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 755

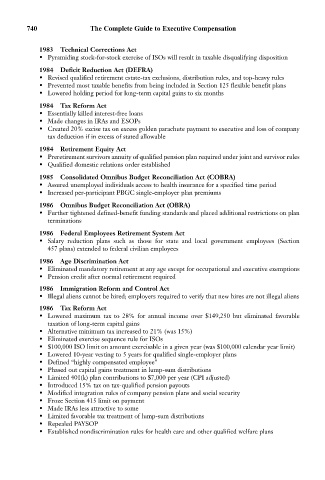

740 The Complete Guide to Executive Compensation

1983 Technical Corrections Act

• Pyramiding stock-for-stock exercise of ISOs will result in taxable disqualifying disposition

1984 Deficit Reduction Act (DEFRA)

• Revised qualified retirement estate-tax exclusions, distribution rules, and top-heavy rules

• Prevented most taxable benefits from being included in Section 125 flexible benefit plans

• Lowered holding period for long-term capital gains to six months

1984 Tax Reform Act

• Essentially killed interest-free loans

• Made changes in IRAs and ESOPs

• Created 20% excise tax on excess golden parachute payment to executive and loss of company

tax deduction if in excess of stated allowable

1984 Retirement Equity Act

• Preretirement survivors annuity of qualified pension plan required under joint and survivor rules

• Qualified domestic relations order established

1985 Consolidated Omnibus Budget Reconciliation Act (COBRA)

• Assured unemployed individuals access to health insurance for a specified time period

• Increased per-participant PBGC single-employer plan premiums

1986 Omnibus Budget Reconciliation Act (OBRA)

• Further tightened defined-benefit funding standards and placed additional restrictions on plan

terminations

1986 Federal Employees Retirement System Act

• Salary reduction plans such as those for state and local government employees (Section

457 plans) extended to federal civilian employees

1986 Age Discrimination Act

• Eliminated mandatory retirement at any age except for occupational and executive exemptions

• Pension credit after normal retirement required

1986 Immigration Reform and Control Act

• Illegal aliens cannot be hired; employers required to verify that new hires are not illegal aliens

1986 Tax Reform Act

• Lowered maximum tax to 28% for annual income over $149,250 but eliminated favorable

taxation of long-term capital gains

• Alternative minimum tax increased to 21% (was 15%)

• Eliminated exercise sequence rule for ISOs

• $100,000 ISO limit on amount exercisable in a given year (was $100,000 calendar year limit)

• Lowered 10-year vesting to 5 years for qualified single-employer plans

• Defined “highly compensated employee”

• Phased out capital gains treatment in lump-sum distributions

• Limited 401(k) plan contributions to $7,000 per year (CPI adjusted)

• Introduced 15% tax on tax-qualified pension payouts

• Modified integration rules of company pension plans and social security

• Froze Section 415 limit on payment

• Made IRAs less attractive to some

• Limited favorable tax treatment of lump-sum distributions

• Repealed PAYSOP

• Established nondiscrimination rules for health care and other qualified welfare plans