Page 760 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 760

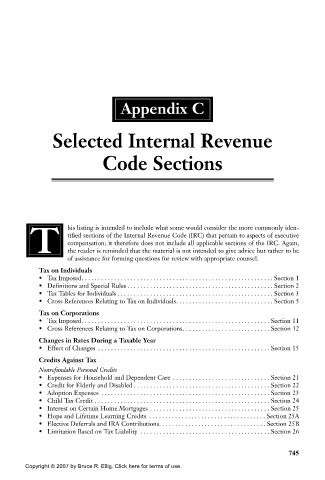

Appendix C

Selected Internal Revenue

Code Sections

T his listing is intended to include what some would consider the more commonly iden-

tified sections of the Internal Revenue Code (IRC) that pertain to aspects of executive

compensation; it therefore does not include all applicable sections of the IRC. Again,

the reader is reminded that the material is not intended to give advice but rather to be

of assistance for forming questions for review with appropriate counsel.

Tax on Individuals

• Tax Imposed. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 1

• Definitions and Special Rules . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 2

• Tax Tables for Individuals . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 3

• Cross References Relating to Tax on Individuals. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 5

Tax on Corporations

• Tax Imposed. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 11

• Cross References Relating to Tax on Corporations. . . . . . . . . . . . . . . . . . . . . . . . . . . Section 12

Changes in Rates During a Taxable Year

• Effect of Changes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 15

Credits Against Tax

Nonrefundable Personal Credits

• Expenses for Household and Dependent Care . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 21

• Credit for Elderly and Disabled . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 22

• Adoption Expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 23

• Child Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 24

• Interest on Certain Home Mortgages . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 25

• Hope and Lifetime Learning Credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 25A

• Elective Deferrals and IRA Contributions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 25B

• Limitation Based on Tax Liability . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 26

745

Copyright © 2007 by Bruce R. Ellig. Click here for terms of use.