Page 759 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 759

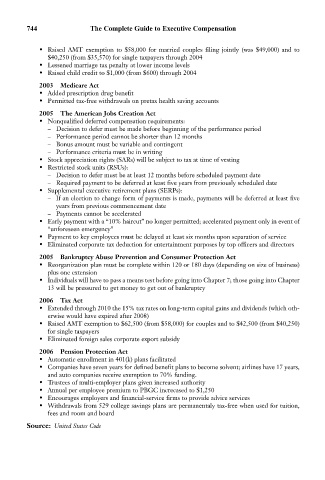

744 The Complete Guide to Executive Compensation

• Raised AMT exemption to $58,000 for married couples filing jointly (was $49,000) and to

$40,250 (from $35,570) for single taxpayers through 2004

• Lessened marriage tax penalty at lower income levels

• Raised child credit to $1,000 (from $600) through 2004

2003 Medicare Act

• Added prescription drug benefit

• Permitted tax-free withdrawals on pretax health saving accounts

2005 The American Jobs Creation Act

• Nonqualified deferred compensation requirements:

– Decision to defer must be made before beginning of the performance period

– Performance period cannot be shorter than 12 months

– Bonus amount must be variable and contingent

– Performance criteria must be in writing

• Stock appreciation rights (SARs) will be subject to tax at time of vesting

• Restricted stock units (RSUs):

– Decision to defer must be at least 12 months before scheduled payment date

– Required payment to be deferred at least five years from previously scheduled date

• Supplemental executive retirement plans (SERPs):

– If an election to change form of payments is made, payments will be deferred at least five

years from previous commencement date

– Payments cannot be accelerated

• Early payment with a “10% haircut” no longer permitted; accelerated payment only in event of

“unforeseen emergency”

• Payment to key employees must be delayed at least six months upon separation of service

• Eliminated corporate tax deduction for entertainment purposes by top officers and directors

2005 Bankruptcy Abuse Prevention and Consumer Protection Act

• Reorganization plan must be complete within 120 or 180 days (depending on size of business)

plus one extension

• Individuals will have to pass a means test before going into Chapter 7; those going into Chapter

13 will be pressured to get money to get out of bankruptcy

2006 Tax Act

• Extended through 2010 the 15% tax rates on long-term capital gains and dividends (which oth-

erwise would have expired after 2008)

• Raised AMT exemption to $62,500 (from $58,000) for couples and to $42,500 (from $40,250)

for single taxpayers

• Eliminated foreign sales corporate export subsidy

2006 Pension Protection Act

• Automatic enrollment in 401(k) plans facilitated

• Companies have seven years for defined benefit plans to become solvent; airlines have 17 years,

and auto companies receive exemption to 70% funding.

• Trustees of multi-employer plans given increased authority

• Annual per employee premium to PBGC increcased to $1,250

• Encourages employers and financial-service firms to provide advice services

• Withdrawals from 529 college savings plans are permanentaly tax-free when used for tuition,

fees and room and board

Source: United States Code