Page 764 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 764

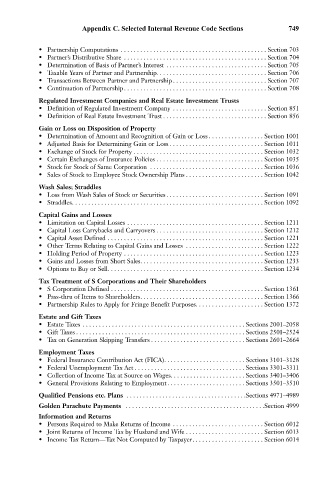

Appendix C. Selected Internal Revenue Code Sections 749

• Partnership Computations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 703

• Partner’s Distributive Share . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 704

• Determination of Basis of Partner’s Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 705

• Taxable Years of Partner and Partnership. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 706

• Transactions Between Partner and Partnership . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 707

• Continuation of Partnership . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 708

Regulated Investment Companies and Real Estate Investment Trusts

• Definition of Regulated Investment Company . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 851

• Definition of Real Estate Investment Trust . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 856

Gain or Loss on Disposition of Property

• Determination of Amount and Recognition of Gain or Loss . . . . . . . . . . . . . . . . . Section 1001

• Adjusted Basis for Determining Gain or Loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 1011

• Exchange of Stock for Property . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 1032

• Certain Exchanges of Insurance Policies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 1035

• Stock for Stock of Same Corporation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 1036

• Sales of Stock to Employee Stock Ownership Plans . . . . . . . . . . . . . . . . . . . . . . . . Section 1042

Wash Sales; Straddles

• Loss from Wash Sales of Stock or Securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 1091

• Straddles. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 1092

Capital Gains and Losses

• Limitation on Capital Losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 1211

• Capital Loss Carrybacks and Carryovers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 1212

• Capital Asset Defined . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 1221

• Other Terms Relating to Capital Gains and Losses . . . . . . . . . . . . . . . . . . . . . . . . Section 1222

• Holding Period of Property . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 1223

• Gains and Losses from Short Sales. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 1233

• Options to Buy or Sell. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 1234

Tax Treatment of S Corporations and Their Shareholders

• S Corporation Defined . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 1361

• Pass-thru of Items to Shareholders. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 1366

• Partnership Rules to Apply for Fringe Benefit Purposes. . . . . . . . . . . . . . . . . . . . . Section 1372

Estate and Gift Taxes

• Estate Taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Sections 2001–2058

• Gift Taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Sections 2501–2524

• Tax on Generation Skipping Transfers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Sections 2601–2664

Employment Taxes

• Federal Insurance Contribution Act (FICA). . . . . . . . . . . . . . . . . . . . . . . . . Sections 3101–3128

• Federal Unemployment Tax Act . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Sections 3301–3311

• Collection of Income Tax at Source on Wages. . . . . . . . . . . . . . . . . . . . . . . Sections 3401–3406

• General Provisions Relating to Employment . . . . . . . . . . . . . . . . . . . . . . . . Sections 3501–3510

Qualified Pensions etc. Plans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Sections 4971–4989

Golden Parachute Payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Section 4999

Information and Returns

• Persons Required to Make Returns of Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . Section 6012

• Joint Returns of Income Tax by Husband and Wife . . . . . . . . . . . . . . . . . . . . . . . . Section 6013

• Income Tax Return—Tax Not Computed by Taxpayer. . . . . . . . . . . . . . . . . . . . . . Section 6014