Page 768 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 768

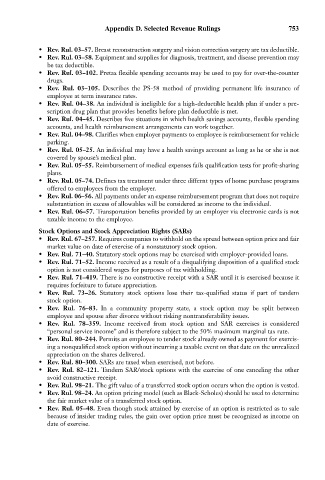

Appendix D. Selected Revenue Rulings 753

• Rev. Rul. 03–57. Breast reconstruction surgery and vision correction surgery are tax deductible.

• Rev. Rul. 03–58. Equipment and supplies for diagnosis, treatment, and disease prevention may

be tax deductible.

• Rev. Rul. 03–102. Pretax flexible spending accounts may be used to pay for over-the-counter

drugs.

• Rev. Rul. 03–105. Describes the PS-58 method of providing permanent life insurance of

employee at term insurance rates.

• Rev. Rul. 04–38. An individual is ineligible for a high-deductible health plan if under a pre-

scription drug plan that provides benefits before plan deductible is met.

• Rev. Rul. 04–45. Describes five situations in which health savings accounts, flexible spending

accounts, and health reimbursement arrangements can work together.

• Rev. Rul. 04–98. Clarifies when employer payments to employee is reimbursement for vehicle

parking.

• Rev. Rul. 05–25. An individual may have a health savings account as long as he or she is not

covered by spouse’s medical plan.

• Rev. Rul. 05–55. Reimbursement of medical expenses fails qualification tests for profit-sharing

plans.

• Rev. Rul. 05–74. Defines tax treatment under three differnt types of home purchase programs

offered to employees from the employer.

• Rev. Rul. 06–56. All payments under an expense reimbursement program that does not require

substantiation in excess of allowables will be considered as income to the individual.

• Rev. Rul. 06–57. Transportation benefits provided by an employer via electronic cards is not

taxable income to the employee.

Stock Options and Stock Appreciation Rights (SARs)

• Rev. Rul. 67–257. Requires companies to withhold on the spread between option price and fair

market value on date of exercise of a nonstatutory stock option.

• Rev. Rul. 71–40. Statutory stock options may be exercised with employer-provided loans.

• Rev. Rul. 71–52. Income received as a result of a disqualifying disposition of a qualified stock

option is not considered wages for purposes of tax withholding.

• Rev. Rul. 71–419. There is no constructive receipt with a SAR until it is exercised because it

requires forfeiture to future appreciation.

• Rev. Rul. 73–26. Statutory stock options lose their tax-qualified status if part of tandem

stock option.

• Rev. Rul. 76–83. In a community property state, a stock option may be split between

employee and spouse after divorce without risking nontransferability issues.

• Rev. Rul. 78–359. Income received from stock option and SAR exercises is considered

“personal service income” and is therefore subject to the 50% maximum marginal tax rate.

• Rev. Rul. 80–244. Permits an employee to tender stock already owned as payment for exercis-

ing a nonqualified stock option without incurring a taxable event on that date on the unrealized

appreciation on the shares delivered.

• Rev. Rul. 80–300. SARs are taxed when exercised, not before.

• Rev. Rul. 82–121. Tandem SAR/stock options with the exercise of one canceling the other

avoid constructive receipt.

• Rev. Rul. 98–21. The gift value of a transferred stock option occurs when the option is vested.

• Rev. Rul. 98–24. An option pricing model (such as Black-Scholes) should be used to determine

the fair market value of a transferred stock option.

• Rev. Rul. 05–48. Even though stock attained by exercise of an option is restricted as to sale

because of insider trading rules, the gain over option price must be recognized as income on

date of exercise.