Page 766 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 766

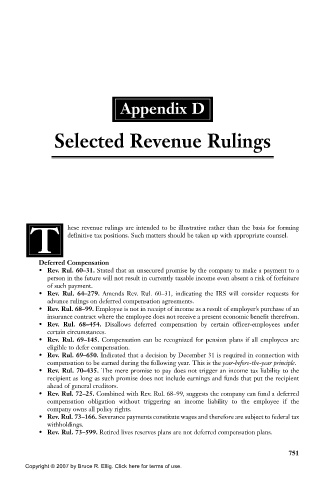

Appendix D

Selected Revenue Rulings

T hese revenue rulings are intended to be illustrative rather than the basis for forming

definitive tax positions. Such matters should be taken up with appropriate counsel.

Deferred Compensation

• Rev. Rul. 60–31. Stated that an unsecured promise by the company to make a payment to a

person in the future will not result in currently taxable income even absent a risk of forfeiture

of such payment.

• Rev. Rul. 64–279. Amends Rev. Rul. 60–31, indicating the IRS will consider requests for

advance rulings on deferred compensation agreements.

• Rev. Rul. 68–99. Employee is not in receipt of income as a result of employer’s purchase of an

insurance contract where the employee does not receive a present economic benefit therefrom.

• Rev. Rul. 68–454. Disallows deferred compensation by certain officer-employees under

certain circumstances.

• Rev. Rul. 69–145. Compensation can be recognized for pension plans if all employees are

eligible to defer compensation.

• Rev. Rul. 69–650. Indicated that a decision by December 31 is required in connection with

compensation to be earned during the following year. This is the year-before-the-year principle.

• Rev. Rul. 70–435. The mere promise to pay does not trigger an income tax liability to the

recipient as long as such promise does not include earnings and funds that put the recipient

ahead of general creditors.

• Rev. Rul. 72–25. Combined with Rev. Rul. 68–99, suggests the company can fund a deferred

compensation obligation without triggering an income liability to the employee if the

company owns all policy rights.

• Rev. Rul. 73–166. Severance payments constitute wages and therefore are subject to federal tax

withholdings.

• Rev. Rul. 73–599. Retired lives reserves plans are not deferred compensation plans.

751

Copyright © 2007 by Bruce R. Ellig. Click here for terms of use.