Page 770 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 770

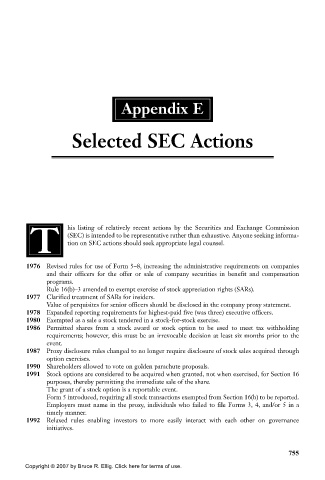

Appendix E

Selected SEC Actions

T his listing of relatively recent actions by the Securities and Exchange Commission

(SEC) is intended to be representative rather than exhaustive. Anyone seeking informa-

tion on SEC actions should seek appropriate legal counsel.

1976 Revised rules for use of Form 5–8, increasing the administrative requirements on companies

and their officers for the offer or sale of company securities in benefit and compensation

programs.

Rule 16(b)–3 amended to exempt exercise of stock appreciation rights (SARs).

1977 Clarified treatment of SARs for insiders.

Value of perquisites for senior officers should be disclosed in the company proxy statement.

1978 Expanded reporting requirements for highest-paid five (was three) executive officers.

1980 Exempted as a sale a stock tendered in a stock-for-stock exercise.

1986 Permitted shares from a stock award or stock option to be used to meet tax withholding

requirements; however, this must be an irrevocable decision at least six months prior to the

event.

1987 Proxy disclosure rules changed to no longer require disclosure of stock sales acquired through

option exercises.

1990 Shareholders allowed to vote on golden parachute proposals.

1991 Stock options are considered to be acquired when granted, not when exercised, for Section 16

purposes, thereby permitting the immediate sale of the share.

The grant of a stock option is a reportable event.

Form 5 introduced, requiring all stock transactions exempted from Section 16(b) to be reported.

Employers must name in the proxy, individuals who failed to file Forms 3, 4, and/or 5 in a

timely manner.

1992 Relaxed rules enabling investors to more easily interact with each other on governance

initiatives.

755

Copyright © 2007 by Bruce R. Ellig. Click here for terms of use.