Page 775 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 775

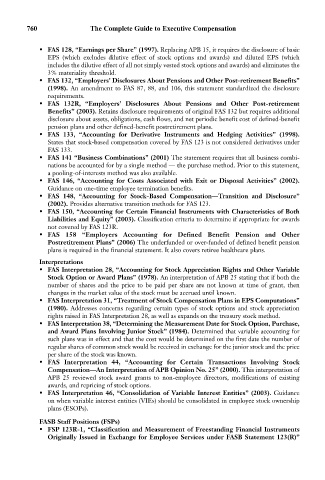

760 The Complete Guide to Executive Compensation

• FAS 128, “Earnings per Share” (1997). Replacing APB 15, it requires the disclosure of basic

EPS (which excludes dilutive effect of stock options and awards) and diluted EPS (which

includes the dilutive effect of all not simply vested stock options and awards) and eliminates the

3% materiality threshold.

• FAS 132, “Employers’ Disclosures About Pensions and Other Post-retirement Benefits”

(1998). An amendment to FAS 87, 88, and 106, this statement standardized the disclosure

requirements.

• FAS 132R, “Employers’ Disclosures About Pensions and Other Post-retirement

Benefits” (2003). Retains disclosure requirements of original FAS 132 but requires additional

disclosure about assets, obligations, cash flows, and net periodic benefit cost of defined-benefit

pension plans and other defined-benefit postretirement plans.

• FAS 133, “Accounting for Derivative Instruments and Hedging Activities” (1998).

States that stock-based compensation covered by FAS 123 is not considered derivatives under

FAS 133.

• FAS 141 “Business Combinations” (2001) The statement requires that all business combi-

nations be accounted for by a single method — the purchase method. Prior to this statement,

a pooling-of-interests method was also available.

• FAS 146, “Accounting for Costs Associated with Exit or Disposal Activities” (2002).

Guidance on one-time employee termination benefits.

• FAS 148, “Accounting for Stock-Based Compensation—Transition and Disclosure”

(2002). Provides alternative transition methods for FAS 123.

• FAS 150, “Accounting for Certain Financial Instruments with Characteristics of Both

Liabilities and Equity” (2003). Classification criteria to determine if appropriate for awards

not covered by FAS 123R.

• FAS 158 “Employers Accounting for Defined Benefit Pension and Other

Postretitrement Plans” (2006) The underfunded or over-funded of defined benefit pension

plans is required in the financial statement. It also covers retiree healthcare plans.

Interpretations

• FAS Interpretation 28, “Accounting for Stock Appreciation Rights and Other Variable

Stock Option or Award Plans” (1978). An interpretation of APB 25 stating that if both the

number of shares and the price to be paid per share are not known at time of grant, then

changes in the market value of the stock must be accrued until known.

• FAS Interpretation 31, “Treatment of Stock Compensation Plans in EPS Computations”

(1980). Addresses concerns regarding certain types of stock options and stock appreciation

rights raised in FAS Interpretation 28, as well as expands on the treasury stock method.

• FAS Interpretation 38, “Determining the Measurement Date for Stock Option, Purchase,

and Award Plans Involving Junior Stock” (1984). Determined that variable accounting for

such plans was in effect and that the cost would be determined on the first date the number of

regular shares of common stock would be received in exchange for the junior stock and the price

per share of the stock was known.

• FAS Interpretation 44, “Accounting for Certain Transactions Involving Stock

Compensation—An Interpretation of APB Opinion No. 25” (2000). This interpretation of

APB 25 reviewed stock award grants to non-employee directors, modifications of existing

awards, and repricing of stock options.

• FAS Interpretation 46, “Consolidation of Variable Interest Entities” (2003). Guidance

on when variable interest entities (VIEs) should be consolidated in employee stock ownership

plans (ESOPs).

FASB Staff Positions (FSPs)

• FSP 123R-1, “Classification and Measurement of Freestanding Financial Instruments

Originally Issued in Exchange for Employee Services under FASB Statement 123(R)”