Page 778 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 778

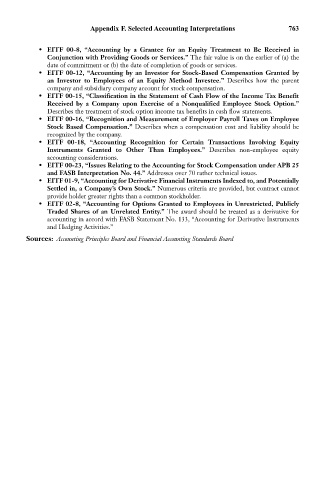

Appendix F. Selected Accounting Interpretations 763

• EITF 00-8, “Accounting by a Grantee for an Equity Treatment to Be Received in

Conjunction with Providing Goods or Services.” The fair value is on the earlier of (a) the

date of commitment or (b) the date of completion of goods or services.

• EITF 00-12, “Accounting by an Investor for Stock-Based Compensation Granted by

an Investor to Employees of an Equity Method Investee.” Describes how the parent

company and subsidiary company account for stock compensation.

• EITF 00-15, “Classification in the Statement of Cash Flow of the Income Tax Benefit

Received by a Company upon Exercise of a Nonqualified Employee Stock Option.”

Describes the treatment of stock option income tax benefits in cash flow statements.

• EITF 00-16, “Recognition and Measurement of Employer Payroll Taxes on Employee

Stock Based Compensation.” Describes when a compensation cost and liability should be

recognized by the company.

• EITF 00-18, “Accounting Recognition for Certain Transactions Involving Equity

Instruments Granted to Other Than Employees.” Describes non-employee equity

accounting considerations.

• EITF 00-23, “Issues Relating to the Accounting for Stock Compensation under APB 25

and FASB Interpretation No. 44.” Addresses over 70 rather technical issues.

• EITF 01-9, “Accounting for Derivative Financial Instruments Indexed to, and Potentially

Settled in, a Company’s Own Stock.” Numerous criteria are provided, but contract cannot

provide holder greater rights than a common stockholder.

• EITF 02-8, “Accounting for Options Granted to Employees in Unrestricted, Publicly

Traded Shares of an Unrelated Entity.” The award should be treated as a derivative for

accounting in accord with FASB Statement No. 133, “Accounting for Derivative Instruments

and Hedging Activities.”

Sources: Accounting Principles Board and Financial Accounting Standards Board