Page 776 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 776

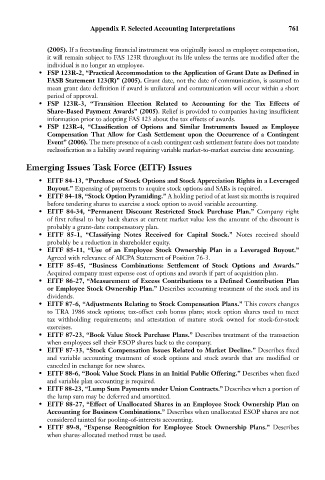

Appendix F. Selected Accounting Interpretations 761

(2005). If a freestanding financial instrument was originally issued as employee compensation,

it will remain subject to FAS 123R throughout its life unless the terms are modified after the

individual is no longer an employee.

• FSP 123R-2, “Practical Accommodation to the Application of Grant Date as Defined in

FASB Statement 123(R)” (2005). Grant date, not the date of communication, is assumed to

mean grant date definition if award is unilateral and communication will occur within a short

period of approval.

• FSP 123R-3, “Transition Election Related to Accounting for the Tax Effects of

Share-Based Payment Awards” (2005). Relief is provided to companies having insufficient

information prior to adopting FAS 123 about the tax effects of awards.

• FSP 123R-4, “Classification of Options and Similar Instruments Issued as Employee

Compensation That Allow for Cash Settlement upon the Occurrence of a Contingent

Event” (2006). The mere presence of a cash contingent cash settlement feature does not mandate

reclassification as a liability award requiring variable market-to-market exercise date accounting.

Emerging Issues Task Force (EITF) Issues

• EITF 84-13, “Purchase of Stock Options and Stock Appreciation Rights in a Leveraged

Buyout.” Expensing of payments to acquire stock options and SARs is required.

• EITF 84-18, “Stock Option Pyramiding.” A holding period of at least six months is required

before tendering shares to exercise a stock option to avoid variable accounting.

• EITF 84-34, “Permanent Discount Restricted Stock Purchase Plan.” Company right

of first refusal to buy back shares at current market value less the amount of the discount is

probably a grant-date compensatory plan.

• EITF 85-1, “Classifying Notes Received for Capital Stock.” Notes received should

probably be a reduction in shareholder equity.

• EITF 85-11, “Use of an Employee Stock Ownership Plan in a Leveraged Buyout.”

Agreed with relevance of AICPA Statement of Position 76-3.

• EITF 85-45, “Business Combinations: Settlement of Stock Options and Awards.”

Acquired company must expense cost of options and awards if part of acquisition plan.

• EITF 86-27, “Measurement of Excess Contributions to a Defined Contribution Plan

or Employee Stock Ownership Plan.” Describes accounting treatment of the stock and its

dividends.

• EITF 87-6, “Adjustments Relating to Stock Compensation Plans.” This covers changes

to TRA 1986 stock options; tax-offset cash bonus plans; stock option shares used to meet

tax withholding requirements; and attestation of mature stock owned for stock-for-stock

exercises.

• EITF 87-23, “Book Value Stock Purchase Plans.” Describes treatment of the transaction

when employees sell their ESOP shares back to the company.

• EITF 87-33, “Stock Compensation Issues Related to Market Decline.” Describes fixed

and variable accounting treatment of stock options and stock awards that are modified or

canceled in exchange for new shares.

• EITF 88-6, “Book Value Stock Plans in an Initial Public Offering.” Describes when fixed

and variable plan accounting is required.

• EITF 88-23, “Lump Sum Payments under Union Contracts.” Describes when a portion of

the lump sum may be deferred and amortized.

• EITF 88-27, “Effect of Unallocated Shares in an Employee Stock Ownership Plan on

Accounting for Business Combinations.” Describes when unallocated ESOP shares are not

considered tainted for pooling-of-interests accounting.

• EITF 89-8, “Expense Recognition for Employee Stock Ownership Plans.” Describes

when shares-allocated method must be used.