Page 774 - Bruce Ellig - The Complete Guide to Executive Compensation (2007)

P. 774

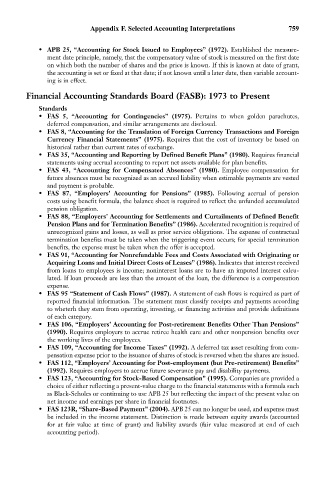

Appendix F. Selected Accounting Interpretations 759

• APB 25, “Accounting for Stock Issued to Employees” (1972). Established the measure-

ment date principle, namely, that the compensatory value of stock is measured on the first date

on which both the number of shares and the price is known. If this is known at date of grant,

the accounting is set or fixed at that date; if not known until a later date, then variable account-

ing is in effect.

Financial Accounting Standards Board (FASB): 1973 to Present

Standards

• FAS 5, “Accounting for Contingencies” (1975). Pertains to when golden parachutes,

deferred compensation, and similar arrangements are disclosed.

• FAS 8, “Accounting for the Translation of Foreign Currency Transactions and Foreign

Currency Financial Statements” (1975). Requires that the cost of inventory be based on

historical rather than current rates of exchange.

• FAS 35, “Accounting and Reporting by Defined Benefit Plans” (1980). Requires financial

statements using accrual accounting to report net assets available for plan benefits.

• FAS 43, “Accounting for Compensated Absences” (1980). Employee compensation for

future absences must be recognized as an accrued liability when estimable payments are vested

and payment is probable.

• FAS 87, “Employers’ Accounting for Pensions” (1985). Following accrual of pension

costs using benefit formula, the balance sheet is required to reflect the unfunded accumulated

pension obligation.

• FAS 88, “Employers’ Accounting for Settlements and Curtailments of Defined Benefit

Pension Plans and for Termination Benefits” (1986). Accelerated recognition is required of

unrecognized gains and losses, as well as prior service obligations. The expense of contractual

termination benefits must be taken when the triggering event occurs; for special termination

benefits, the expense must be taken when the offer is accepted.

• FAS 91, “Accounting for Nonrefundable Fees and Costs Associated with Originating or

Acquiring Loans and Initial Direct Costs of Leases” (1986). Indicates that interest received

from loans to employees is income; noninterest loans are to have an imputed interest calcu-

lated. If loan proceeds are less than the amount of the loan, the difference is a compensation

expense.

• FAS 95 “Statement of Cash Flows” (1987). A statement of cash flows is required as part of

reported financial information. The statement must classify receipts and payments according

to wheterh they stem from operating, investing, or financing activities and provide definitions

of each category.

• FAS 106, “Employers’ Accounting for Post-retirement Benefits Other Than Pensions”

(1990). Requires employers to accrue retiree health care and other nonpension benefits over

the working lives of the employees.

• FAS 109, “Accounting for Income Taxes” (1992). A deferred tax asset resulting from com-

pensation expense prior to the issuance of shares of stock is reversed when the shares are issued.

• FAS 112, “Employers’ Accounting for Post-employment (but Pre-retirement) Benefits”

(1992). Requires employers to accrue future severance pay and disability payments.

• FAS 123, “Accounting for Stock-Based Compensation” (1995). Companies are provided a

choice of either reflecting a present-value charge to the financial statements with a formula such

as Black-Scholes or continuing to use APB 25 but reflecting the impact of the present value on

net income and earnings per share in financial footnotes.

• FAS 123R, “Share-Based Payment” (2004). APB 25 can no longer be used, and expense must

be included in the income statement. Distinction is made between equity awards (accounted

for at fair value at time of grant) and liability awards (fair value measured at end of each

accounting period).